The Thai government provides an opportunity to get VAT refunds for purchases made in stores. This thing is called VAT Refund. There are certain conditions for this to be done. I will tell you about them in my post. I myself performed this procedure at the Bangkok airport when returned VAT for the Sony A6500 camera. Nice bonus turned out, 2710 baht returned.

The content of the article

- one Terms of return VAT 7% in Thailand

- 2 What is VAT Refund how to get a certificate

- 3 How to get VAT refund at the airport

Terms of return VAT 7% in Thailand

To get VAT back on your purchase, the following conditions must be met:

There is information that it is desirable to preserve the whole package and, in general, the presentation, but I am not sure of its veracity. At least not everyone is asked for packaging, the main thing is that the product is there. So see for yourself whether it's worth it or not. I carried the camera in a box, I needed it myself, so I wouldn't throw it away anyway.

What is VAT Refund how to get a certificate

VAT Refund is a refund of VAT, i.e. value added tax. In Thailand, the tax is 7%, but in fact, you can return not 7%, but a smaller amount. It is spelled out in a specific table and depends on the purchase amount, the larger the amount, the greater the percentage. Expect somewhere around 4-6%. Information on all sites where it is written that exactly 7% can be returned is incorrect.

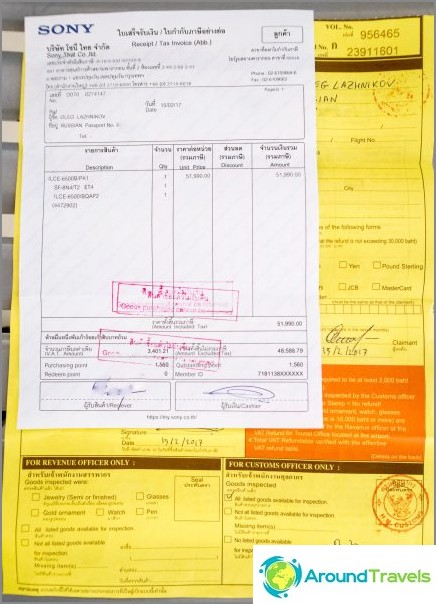

For example, my Sony a6500 camera cost 51,990 baht. At the airport, 2710 baht was returned to me, that is, 5.2%. In principle, not bad, considering that the whole procedure does not take much time. Although if you are going to do this, you still need to arrive at the airport a little in advance. A similar service is available not only in Thailand, but in other countries. I also returned VAT in Warsaw for the purchase of a baby stroller.

To receive money, you need a VAT refund certificate. This is the official paper that is issued in the store at the time of purchase. To get it, you need a foreign passport, so you must definitely take it with you. You can fill out form P.P.10 (Vat Refund Application for Tourists), either yourself or a store employee. Try not to be mistaken so that the passport number, surname, amount, date, etc. are correctly indicated.

In addition to the certificate, you will need to show at the airport and the receipt of payment, do not forget it.

Unfortunately, not all shops in Thailand provide the opportunity to issue a VAT Refund certificate. Usually we are talking about large shopping centers and stores in them. On the glass (showcase) near the entrance or near the ticket office, you need to look for the VAT Refund sign.

VAT Refund in Thailand

Since 4-5% is not a very large amount, it is obvious that it makes sense to refund VAT in the case of large purchases. Because, for example, for 2000 baht the refund is only 80 baht, for 5000 baht - 250 baht.

I personally would not bother with small amounts. Alternatively, if you make several purchases for different amounts, then you can try to issue a general VAT certificate for them. You collect all your checks, each of which has an amount of at least 2,000 baht and issue one general certificate for them in a special service department. They say this is in Central Festival, but I have not checked it myself.

How to get VAT refund at the airport

I will describe the VAT Refund procedure at Bangkok Suvarnabhumi Airport. Strictly in this sequence.

- In the departure hall on the 4th floor on the right side at the very end, near the glass, look for the Vat Refund office. There you give a certificate from the store, your passport and a check. Here you will most likely be asked to show the product (I was asked).

- They put a red seal on your certificate and all documents will be returned. Without this seal, you will receive nothing later..

- Next, you check in for the flight, check in your luggage and go through passport control. In principle, it was possible to register immediately, and then go to look for a Vat Refund office, if you do not plan to check in the goods.

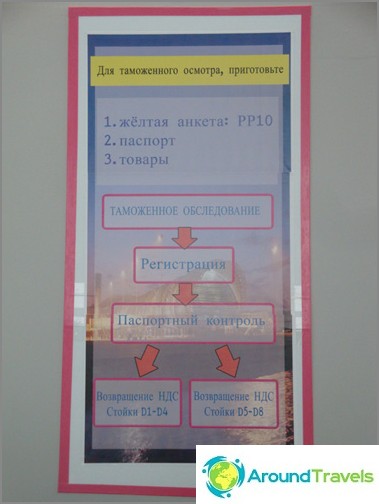

- After passport control in the Duty Free zone, follow the signs to the VAT Refund ticket office, it is located in the area of gates D1-D4.

- You give the documents at the checkout and receive the money. If this is cash, then you will be given baht, which can be exchanged for bucks in one of the exchangers.

Phuket airport has a slightly different scheme. There, you first need to go through passport control, and then deal with the registration and tax refund..

How to apply for Vat Refund in Bangkok

Vat Refund office at Suvarnabhumi Airport on the 4th floor

Here you will be given the necessary stamps

After passport control, follow the Vat Refund signs

Cashier VAT Refund in the transit area of Bangkok airport

And one more nuance, you can get VAT in 3 ways: in cash, by check to the bank, by transfer to a credit card.

You can get money in your hands only if the amount to be returned does not exceed 30,000 baht. Otherwise, a check or transfer to a credit card is issued with a commission of 100 baht and transfer fees.

Receipt of Vat and commission receipt