Since I once registered an IP (my detailed instruction), then I also have to use a separate bank account for business. I already wrote general information about opening a current account, and in this post I would like to lay out a small comparison of tariffs of various banks, including those that were advised in the comments.

Basically, we will talk about Moscow banks, but they are often represented in the regions, and their tariffs will be lower.

The content of the article

- one Comparison of bank tariffs for individual entrepreneurs

- 2 Personal experience

- 3 Banks for those who use My Case

Comparison of bank tariffs for individual entrepreneurs

Due to the unstable economic situation in the country and the revocation of licenses from banks, it is believed that it is better to choose top and large banks, so that later you do not have to pull money out of small ones through the DIA (individual entrepreneurs' accounts are insured up to 1.4 million rubles). But I would not say that it is difficult, just for a while the money will be «frozen. Alternatively, you can simply not keep large amounts on the IP account and immediately withdraw them.

And, if it comes to that, then in order not to worry at all, then you need to open an account with Alfabank / Sberbank, nothing will happen to them. So see for yourself. The larger and more reliable the bank, the higher your service costs will be. But if you have a big business, then all these commissions against the background of the company's turnover will be penny.

Tinkoff

After the Module lowered the tariffs, Tinkoff Business (the first 2 months for free) began to look more attractive, besides, the bank is still much larger..

Opening an account, connecting to the Internet bank, leaving a representative to the office / apartment - free of charge. A very long operating day, from 1 am to 8 pm, inside the bank around the clock. It is convenient for me, I sometimes do translations in the evening. Intrabank transfers to the accounts of individual entrepreneurs and companies are free.

I have a tariff «Simple» - 490 rubles / month SMS-informing on the account - 99 rubles / month, if there is an operation, 4% on the balance. The first 3 external payments to the accounts of individual entrepreneurs and companies are free, then 49 rubles. But with payments to individuals there is an ambush - 1.5% of the amount (plus 99 rubles) within 400 thousand rubles, with large amounts the commission is higher. But if we are talking about transfers to yourself, then you can transfer up to 150 thousand rubles / month to your Tinkoff Black debit card, and 250 thousand rubles / month to a credit card. Or a total of 400 thousand rubles per month. IMHO is enough.

Rate «Advanced» - 1990 rubles / month SMS-informing on the account - 99 rubles / month, if there is an operation, 6% on the balance. The first 10 external payments to the accounts of individual entrepreneurs and companies are free, then 29 rubles. Payments to individuals - 1% of the amount (plus 79 rubles) within 400 thousand rubles, with large amounts the commission is higher. But if we are talking about transfers to yourself, then you can transfer up to 300 thousand rubles / month to your Tinkoff Black debit card, and 400 thousand rubles / month to a credit card. Or a total of 700 thousand rubles per month.

Rate «Professional» - 4990 rubles / month.

Try Tinkoff>

Withdrawing cash from the card - 1.5% within 400 thousand rubles / month in the Simple tariff and 1% within 400 thousand rubles / month on the Advanced. Card with a separate account and free service.

Thus, if you do not want to make Tinkoff bank cards for yourself, or you have physicists on a salary, then you need to look for something else. For example, Point is a bank with good rates. And the tariffs are easier to understand.

Foreign exchange transfers

Maintaining foreign currency accounts is free. You can transfer currency to an individual's account within Tinkoff to avoid commissions on transfers to other banks. But the limits for transfers and commissions will be the same as for rubles, I announced them above.

For tariff «Simple». Currency control - 0.2% of the amount (minimum RUB 490). External transfer 0.2% of the transfer amount, minimum 49 ue.

For tariff «Advanced». Currency control - 0.15% of the amount (minimum RUB 290). External transfer 0.15% of the transfer amount, at least 29 ue.

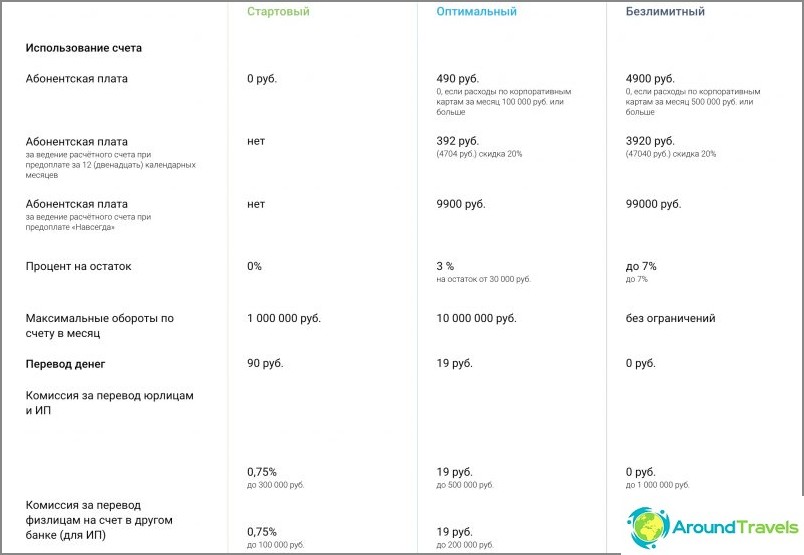

Modulbank

Modulbank suits many categories of entrepreneurs. Opening an account, connecting to the Internet bank, certifying a card with signatures, SMS for all transactions - free of charge.

Rate «Starting» - 0 rubles / month, payment to legal entities 90 rubles, payment to individuals 0.75% (but not less than 90 rubles) within 300 thousand rubles (hereinafter 1%). Suitable for those who have almost no operations at all, I do not consider it at all.

Rate «Optimal» - 490 rubles / month, 3% on the balance, payment to legal entities and individual entrepreneurs - 19 rubles, payment to individuals - 19 rubles within 500 thousand rubles / month (hereinafter 1%). I have this tariff, IMHO it is the most successful. There is also a tariff «Unlimited».

Try Modulbank>

There is also a tariff «Unlimited» for 4900 rubles per month.

They give a free card for withdrawing and depositing cash. She has her own separate account. There are limits and commission for withdrawals, depending on the tariff and the withdrawal amount. Depositing at certain ATMs is free. But I don't use the card, I'm used to withdrawing to an individual's account in another bank.

Modulbank's tariffs for individual entrepreneurs and companies

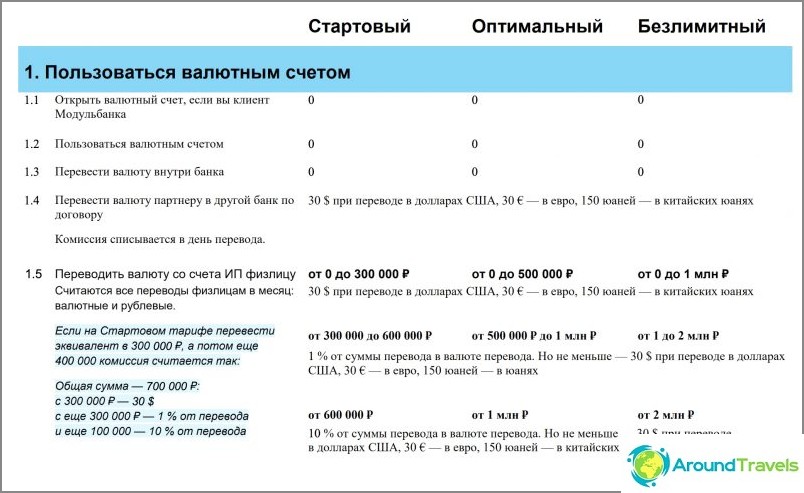

Foreign exchange transfers

Servicing a foreign currency account is free. Transaction passport for Optimal and Unlimited tariffs - free of charge. For currency control, they take 300 rubles for a payment within 500 thousand rubles (in equivalent) and 1000 rubles, if from 500 thousand rubles to 1 million.

Foreign exchange transfer to an individual to another bank 30 dollars, 30 euros or 150 yuan (yes, there are accounts in yuan), up to 500 thousand / 1 million rubles per month (Optimal / Unlimited). If more, then 1%. Somehow so-so. Considering that they do not serve physicists and the currency will have to be withdrawn to another bank anyway. In this regard, it is more convenient when an individual's account is immediately available in the same bank, because intra-bank payments are usually free. But if the currency is not needed, then you can convert into rubles within the Module, they have a currency exchange rate: exchange rate +/- 1%.

He also wrote more than once that the Module has a minus in terms of currency payments, that their intermediary bank takes $ 15 from some payments. In theory, this should depend on how exactly the non-resident counterparty sends them, shifting the entire commission to the recipient or paying part of it on its side. But before, there was no commission for the same payments (I received it in another bank), they appeared only in Module.

Foreign exchange commissions

Point bank

Follow the link for a discount on the tariff «All the best at once» for 3 months. IMHO a very good option for an individual entrepreneur, because the tariffs include many services and you do not need to pay anything extra. Included in the group «Opening», that is, the TOP bank. I recommend thinking about it if you want to open an account with a large bank. And the tariffs are easy to understand..

An interesting feature of any tariff is that there is no monthly service if there were no account transactions. That would be so for everyone. Don't use - don't pay.

Opening an account, connecting an Internet bank, a mobile application, issuing bank cards, leaving a representative to an office / apartment - free of charge.

Rate «Required minimum» - 0 rubles per month All payments, cash withdrawals, transfers to individuals are free of charge. It's a freebie, right? Not really. They take 1% for all incoming receipts up to 300,000 rubles, 5% for amounts from 300,000 rubles to 800,000 rubles, and then 8%. Very good tariff plan for small individual entrepreneurs with low turnover.

Rate «Golden mean» 500 rubles / month, includes 10 free payments in favor of individual entrepreneurs and legal entities, free transfers to an individual's account within 200,000 rubles (hereinafter 0.5%). IMHO the best tariff they have, sufficient for many.

Try Point>

Rate «All the best at once» - 2500 rubles / month (the first 3 months for 500 rubles), includes 100 payments in favor of individual entrepreneurs and legal entities, free transfers to an individual's account within 500,000 rubles (hereinafter 0.5%). Cash withdrawals up to RUB 100,000 are free. Give cashback 2% from taxes.

Opening a foreign currency account is free, maintenance is also free. Currency control 0.15% of the transfer amount, but not less than 350 rubles. There is a paid tariff, there is a slightly lower percentage. Outgoing currency payment 25 ue on the tariff «All the best at once» and 30 ye for the rest.

Tariffs for business in Tochka Bank

Alfa Bank

A bank from the TOP-10, that is, one of the most.

Free: opening ruble and foreign currency accounts, connecting to an Internet bank, a mobile application, issuing a bank card and transfers to legal entities and individual entrepreneurs within Alfabank, SMS notifications. If there are no operations in the current month on tariffs «One percent» and «On your marks», then there is no service charge. A representative can come to your office or home.

Long operating day, like Tinkoff's: from 1:00 am to 7:50 pm, inside the bank around the clock.

Rate «One percent». Everything is free, including SMS notifications. Pay only 1% on all receipts. The Point has exactly the same tariff. Great for small power supplies with low RPM. No income - pay nothing. Opening a foreign currency account is not available.

Rate «On your marks». Account maintenance 490 rubles / month, or free if there are no transactions. 3 external payments to individual entrepreneurs and legal entities free of charge, then 50 rubles. Internal and external transfers to individual accounts are free up to 100 thousand rubles, 1% up to 500 thousand and 1.5% up to 2 million.

Rate «Electronic». Account maintenance 1440 rubles / month When paying for 9 months, they immediately give another 3 months as a gift. Certification of a card with a sample signature - 590 rubles. External payments to individual entrepreneurs and legal entities cost 16 rubles. Internal and external transfers to individual accounts are free up to 150 thousand rubles, 1% up to 300 thousand, 1.5% up to 1 million, and then the commission grows with an increase in the amount.

There are also a few more expensive tariffs. A fairly wide range of tariffs, but there are too many conditions, it's hard to figure it out right away.

To withdraw cash, they give a free Alfa-Cash card (In, Ultra, FIFA) tied to the main current account. Annual service is free for the Alfa-Cash In card (only for cash deposits) and 299 rubles / month for the Ultra card. Cash withdrawal at the tariff «One percent» up to 1.5 million for free. Cash withdrawal up to 100 thousand rubles / month - 1.25% on the tariff «On your marks» (min 129 rubles) and 1.5% on the tariff «Electronic» (min 200 rubles). The higher the withdrawal amount, the higher the commission. Cash depositing 1% of the tariff «One percent», free at «On your marks» and 0.23% y «Electronic.

For currency control they want 600 rubles for each payment within 400 thousand rubles (in equivalent), then 0.15%. Monthly maintenance of a foreign currency account free of charge on the tariff «On your marks» and 1440 rubles / month on the tariff «Electronic». Within Alfbank, all currency transfers are free for the tariff «On your marks». For tariff «Electronic» internal transfers are free only to the accounts of individual entrepreneurs and legal entities, and payments to individuals within the bank or to other banks - 1% (min 900 rubles). On both tariffs, external transfers are charged 0.25% (minimum 57 dollars or 43 euros, maximum 228 dollars or 174 euros).

Raiffeisen

Minimum package «Start» costs 990 rubles / month, there is a discount for when paying for the year. The package includes free account opening and maintenance. Payments for 25 rubles, transfers to individuals within 100,000 rubles without commission, then 1%. Issue a free card to the account, card service «Business 24/7 Basic» - 90 rubles / month SMS notification - 199 rubles / month.

Without a package: opening a ruble / currency account 1700 rubles, maintaining a ruble / currency account 950 rubles / 25 $ per month. Transfer to an individual in Raiffeisen without commission, transfer to an individual in another bank 0.1%, but at least $ 40.

Sberbank

Opening an account is 2400 rubles, but if you have a revenue of up to 1.8 million / year and you want a loan, then 700 rubles. Internet bank connection RUB 960 These were all one-time expenses, let's move on to monthly expenses. Account management RUB 700 / month, fee for using Sberbank Business Online RUB 650 / month, RUB 30 payment.

Opening a currency account 2400 rubles, maintaining a currency account 600 rubles / month. Currency control 0.15% of the amount, at least 10 ye.

These were the general tariffs for RKO. But there are also service packages. For example, «Minimum» RUB 1,500 / month - ruble account + Internet bank + 5 payments. It is not difficult to calculate that everything will be approximately the same without the package. If you pay for several months, there will be a small discount.

Promsvyazbank

Usb-key 1500 rubles, only with it you can use the Internet bank «PSB On-Line». Minimum tariff «Business Light» - 1050 rubles / month, opening an account 590 rubles, payment of 45 rubles. Rate «My Case» - 1250 rubles / month, it immediately includes bank services, payment of 45 rubles, opening an account is free. Give a discount if you pay for several months. Currency control 0.15%, but not less than 750 rubles. SMS informing 199 rubles / month.

Why did they come up with this problem with a USB dongle ... For me right away it is the inability to use, carry a USB flash drive around different countries, God forbid you lose.

Vanguard

Opening an account 1000 rubles (if the application is through the site), maintaining a ruble account 900 rubles / month, maintaining a currency account 500 rubles / month, payment of 25 rubles or $ 30 for dollars, currency control 0.075% (min 400 rubles).

In Vanguard, one point is worth knowing - the money that has come does not need to be withdrawn to your personal account on the same day, otherwise there will be a commission. You just need to make it a rule to make a delay of at least one day before withdrawal.

UBRD

Free account opening, Internet bank and manager's visit. Minimum tariff «Economy» - 500 rubles / month, payment is 25 rubles, but for connecting the package you need to pay another 750 rubles one-time. Rate «Online» - 800 rubles / month, payment of 25 rubles, connection is free. The difference between these tariffs is in «Online» payments around the clock.

Personal experience

Agree, I would not be able to compare these two banks if I had not used Tinkoff too, it would not be fair 🙂

I now have 2 current accounts (Module and Tinkoff). So far I use two, but I'm going to move to Tinkoff, since I have individual cards there. I'll try to compare the most basic points.

- Tinkoff is a larger bank and in terms of financial indicators it is ahead. Included in the people's TOP, but Modulbank is not included.

- Tinkoff has accounts of individuals, and for those who have bank cards like Tinkoff Black there, it will be very convenient to receive money on them instantly and without commissions. Modulbank does not work with individuals, it will only have an individual entrepreneur account.

- Tinkoff has a tariff of 490 rubles / month. Modulbank has a free tariff, but there is a commission for transfers of 0.75% to individuals, so it would be more correct to compare it with the Optimal tariff 490 rubles / month. Thus, the same goes for service. Tinkoff charges another 99 rubles / month for SMS, they are free from the Module. But sms is, in principle, an optional function..

- Tinkoff began opening foreign currency accounts in January 2017, but I did not open it, I can’t say anything. Currency control at Tinkoff 0.2% of the amount (minimum RUB 490), Modulbank has fixed RUB 300 for transactions up to RUB 500 thousand and RUB 1,000 for transactions RUB 500 thousand - RUB 1 million. But the Module has such a problem - for some reason, a commission of 15 ye is taken from some payments on the way, for example, from Google Adsense. With a similar payment to another bank, there is no commission.

- Foreign currency transfers from an individual entrepreneur to an individual's account will be free within Tinkoff Bank. In Modula, you will have to pay at least $ 30 for each currency transfer to your card in another bank..

- Both banks have remote support and you can find out any question via chat, as well as perform some actions.

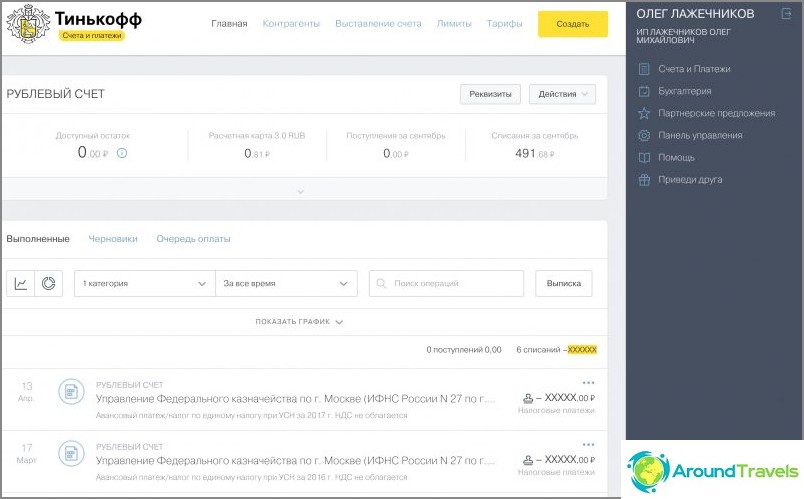

My review about Tinkoff Business

To be honest, I originally wanted to join Tinkoff Business, since I have been using their debit cards for many years. But I was refused without explanation. I suppose there were some technical mistakes, because all this was at the very beginning, when they only offered services to legal entities and individual entrepreneurs. Then I opened an account in Modulbank (about it below), but six months later I again applied to open an account with Tinkoff, and they gave the go-ahead! So keep in mind that if you want to go to Tinkoff, but you were refused, then after a few more months you can try.

I have a small individual entrepreneur and not so many operations per month, so I did not want to pay decent amounts for service every month, it is somehow stupid to overpay for this. Actually, for this reason, I did not consider the top banks, there are no inexpensive tariffs..

Account at Tinkoff + 2 months as a gift>

Tinkoff has a simple, intuitive internet bank. I don't remember having any problems with him at least once. Everything works well! Recently, I increasingly use their mobile application, where you can do the same. Somehow it became more convenient even from the phone. Tech support replies in chat with a slight delay, but always to the point. I'm really happy with it and with a clear conscience I can advise all my friends and subscribers.

Verification of the signature, Internet banking, and opening an account were free, the representative came to my house 3 days after he left the application. We filled out the papers in 10 minutes and he left. It's great, of course, when no one needs to go, as is often the case in other banks..

Internet bank at Tinkoff Business

I can't say anything about currency accounts, I still have currency accounts in Modulbank. Perhaps later I will completely switch to Tinkoff Business, but for now I am too lazy to do this, I use two banks.

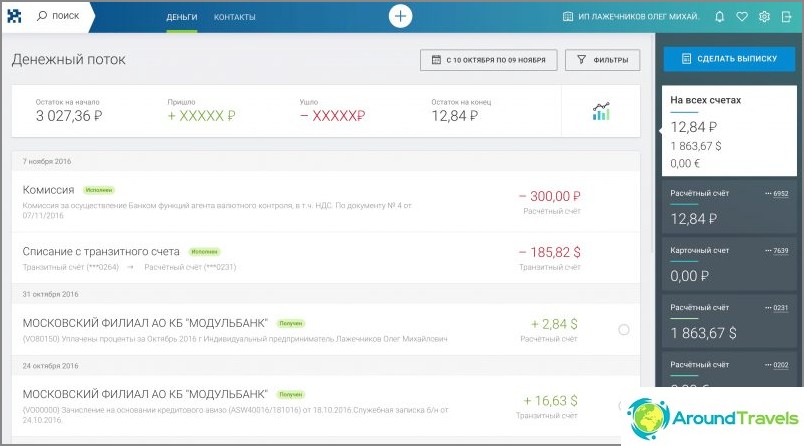

My review about Modulbank

To be honest, when I opened an account with Modulbank, I was not expecting something special. We can say that he opened it out of despair (see the review about Tinkoff). However, the bank turned out to be very convenient.

While everything suits me, no problems have arisen, not a single jamb at all. The procedure for opening an account took about 30 minutes, however, I had to go to their office in Moscow City (now they come home or to the office). Did not pay anything for opening an account, certifying signatures, connecting to the Internet bank.

Account in Modulbank>

The Module has a fairly convenient and intuitive Internet bank, where you can always ask a question in the online chat. Sometimes they answer right away, sometimes you need to wait 10-20 minutes. At night, they often answer that the specialist will answer during working hours the next day. But I corresponded a lot with currency control, they only work during the day. I like that everything is very simple, and there is no such confusion on security, as it was in the late Interactive Bank. There, I remember, you are tortured to confirm the operation with various codes and passwords, but here you just have a text message and that's it..

How does Modulbank's Internet bank look like?

All foreign exchange receipts are also very simple. I just upload screenshots to the online chat, for example, from my Google Adsense personal account (only for the very first time I still need to send an offer). And then I do not need to fill in a bunch of fields in the certificate of a currency operation, I do not need to create an order to transfer from a transit account to a regular one, all this is done automatically, I just need to enter the password from the SMS. Again, I remember how it used to be in other banks, where I made a mistake (there are a lot of fields), so they call and ask to redo everything again. By the way, in Modulbank, foreign currency accounts (dollar, euro, yuan) are opened without visiting the office, also through online chat.

Banks for those who use My Case

The convenient service Moe Delo, which I have been using for 5 years for my accounting and filing reports to the tax, has significantly expanded the list of integrated banks where you can open an account. Alternatively, check out Elba, some like it better.

If you still do not know why you need online accounting services, then read my post. For me personally, life is very easy. Although yes, you can do everything yourself, I admit it. With whom, how much time, lately I have been trying to shift from myself to the maximum, otherwise I have no time to work.

Quotes My Business>

I will not talk about tariffs, service users can get to this page themselves and find out everything. I would not consider all banks, but I have already made my choice - Tinkoff / Modulbank (I have 2 accounts).

Opening a current account for individual entrepreneurs

P.S. I update the post if possible, but tariffs can change quite quickly, so be sure to check everything on the banks' website, and write me comments so that I also fix it on my own..