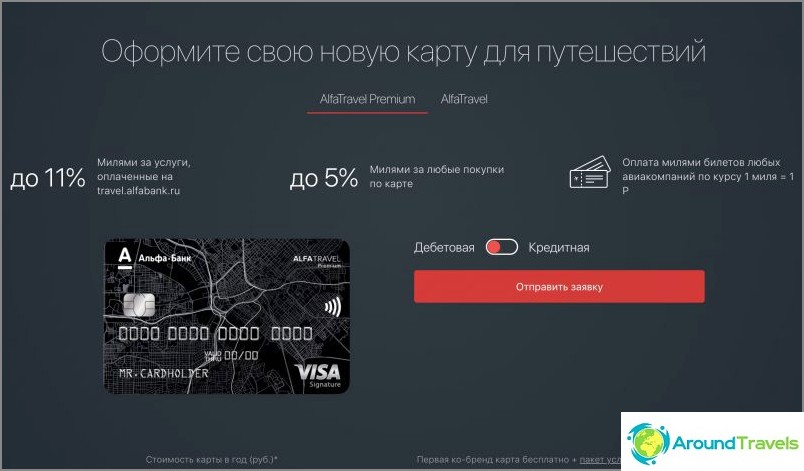

Debit cards from Alfbank for travelers are not bad, which is common, which is Premium. In my opinion, they look even more attractive than credit ones, although usually the opposite is true. I myself am thinking of ordering a Premium card in order to get 5% cashback, in fact, everything is needed for it. Well, and having Priority Pass, although it's already more difficult with it, is not the best offer. But first things first.

The content of the article

Pivot table

For what I do not like Alfabank, it is because they hide commissions and scatter their tariffs on different pages. The devil will break his leg sometimes. But nothing, I figured everything out, I am now sharing with you. I hope I will be clearer to tell you what kind of product Alpha offers for travelers..

I must say right away that getting good conditions for Alfabank's travel cards is far from being for everyone. And the minimum conditions are comparable to many other banks. So how this card won the 2018 Best Traveler award is a question. So let's say, not a mass product.

Max cashback For all Air tickets Hotels Price per year Debit 3 5.5% 9% 0 Debit, Premium 5% 7.5% 11% 0 Credit 2% 2% 4.5% 8% 1290 rubles Credit 3% 3% 5 , 5% 9% 2990 rubles Credit, Premium 5% 7.5% 11% 6490 rubles

Free medical insurance is included with all travel cards.

Priority Pass only goes to Premium.

Alpha Travel Cards for Travel

Detailed conditions

Alfa Travel debit card, regular

The terms of free service and 2% cashback are very easy for most travelers (I would say, for everyone). Therefore, first of all, it is worth considering this card from Alfabank, if there are no other travel cards yet (and you need to start somewhere), and you cannot fulfill more complex conditions. Essentially a free card, but with cashback.

1000 rubles for making a debit>

Cashback For all Air tickets Hotels Price per year for spending up to 10,000 rubles / month 0% 2.4% 6% 100 rubles / month for spending from 10,000 rubles / month 2% 4.5% 8% 0 for spending over 70 000 rub / month 3% 5.5% 9% 0

Cash withdrawals abroad: free.

Medical insurance: 50 thousand euros with the included option «Extreme sport».

Annual service: for spending over 10,000 rubles / month? Free, otherwise 100 rubles / month.

Debit card Alfa Travel, Premium

The most profitable card of the entire line, issued as part of the Premium package. But it is most difficult to fulfill all the conditions for free service and access to business lounges using it. There are also the most goodies: increased cashback for tickets / hotels / purchases, insurance for the whole family, Priority Pass. Cashback for everything at once and so that above 2-3% is now very rare, so it is not surprising that there are a lot of conditions here.

It makes sense to make this card for those who spend more than 100 thousand rubles a month and are ready to keep 1.5 million rubles in Alpha. Or, who is ready to just keep 3 million. In these cases, a pretty good offer is obtained..

1000 rubles for issuing a Premium debit>

Cashback For all Air tickets Hotels Price per year for spending less than 10,000 rubles / month 0% 2.4% 6% 0 * for spending more than 10,000 rubles / month 2% 4.5% 8% 0 * for spending more than 70,000 rub / month 3% 5.5% 9% 0 * when spending more than 100,000 rubles / month 5% 7.5% 11% 0 *

Cash withdrawals abroad: free.

Medical insurance: 150 thousand euros for the whole family with the included option «Extreme sport». You can enter legal spouses, children, parents. They must all accompany the cardholder. Their coverage will be 35 thousand euros..

Priority Pass: pass limits are provided to the Premium package. 4 passes per month - if the average account balance is from 3 million rubles or the average balance is from 1.5 million rubles + spending 100 thousand rubles / month on debit cards. Passes without restrictions, if the average balance is from 6 million rubles or the average balance is from 3 million rubles. + spending 200 thousand rubles / month on debit cards. Passes only for the cardholder, for accompanying persons - $ 27.

Annual service: 0 rubles, since the card is included in the Premium package, its cost is 5000 rubles / month. But the free Premium package can be ensured by fulfilling one of the conditions: an average balance of 1.5 million rubles + spending 100 thousand rubles / month on debit cards, an average balance of 3 million rubles, wages received on the account from 250 thousand rubles.

Alfa Travel credit card, regular

Low-cost credit card, available in 2% or 3% options. It is quite possible to issue it if you are interested in a cashback of 2-3% percent. No fuss, pay an annual commission and earn your miles. The middle one is like that.

1000 rubles for a credit card>

Cashback For all Flights Hotels Price per year when ordering a card with 2% 2% 4.5% 8% 1290 rubles when ordering a card with 3% 3% 5.5% 9% 2990 rubles

Medical insurance: 50 thousand euros with the included option «Extreme sport».

Annual service: 1290 rubles (without a package of services) and 990 rubles (with a package) for a card with 2% cashback. 2990 rubles (without a package of services) and 2490 rubles with a package for a card with 3% cashback.

Credit card Alfa Travel, Premium

This credit card is interesting because you get 5% cashback without any conditions. And 5% is really a lot in modern realities. It's great that you don't have to count anything, do it, there will always be 5% for everything. If there is enough spending in total per year, then the service fee will pay off several times.

It is even possible that having issued a Premium package, it will make sense to issue a Premium credit card. Well, in order not to fool with monthly expenses - after all, in the case of a Premium debit, you need to spend from 100 thousand rubles to ensure that there is 5%, and this is not always possible.

1000 rubles for issuing a Premium credit card>

Cashback For all Flights Hotels Price per year 5% 7.5% 11% 6490 rubles

Medical insurance: 50 thousand euros with the included option «Extreme sport».

Priority Pass: Same conditions as Premium Debit Card.

Annual maintenance: 6490 rubles (without a package of services), 4990 rubles (with a package of services). That is, even in the Premium package you will have to pay for this card. The condition is so-so, given that for the Premium package, too, either pay or provide it free of charge with an amount to the account and spending on debit (!) Cards.

How to use

The main disadvantage of Alpha Travel cards is that cashback is credited in miles (1 mile = 1 ruble), and not in money. And these miles can only be spent on travel.alfabank.ru to buy tickets (air and railway) and hotels. Air tickets are provided by Aviakacca, Ostrovok hotels, prices are wrap-up. But it all depends on the direction, sometimes the difference is small. In any case, the higher price does not reduce the profitability of the cards much..

Rough example. You have accumulated 20 thousand miles with 5% cashback on Alpha. Let the air ticket cost just 20 thousand on Alpha, and 18 thousand on another service (that is, it is 10% cheaper). With a Tinkoff AllAirlines card (2% cashback), you would have accumulated only 8 thousand miles from the same purchases, even for such a ticket is not enough.

On travel.alfabank.ru you need to buy tickets / hotels only for the accumulated miles. Except when their price plus or minus is the same as elsewhere. In fact, Alpha cards are needed for the sake of cashback for all purchases, and not for the sake of cashback for tickets / hotels.

conclusions

Cards are needed primarily for spending. The more you spend, the more profitable they are. It is most profitable to use a card in Russia for constant spending in order to accumulate miles.

Alfabank takes a commission of 3% when you pay by card in foreign currency. Therefore, getting 3% cashback (let's take such a card for comparison), you compensate them for everything. WITH AllAirlines card from Tinkoff the same story, there is a cashback of 2% and a commission of 2%, offset. On the trip, Alpha 3% and Tinkoff 2% are equivalent. But the Alfabank card (if it has 3-5% cashback) comes out more profitable for spending in Russia than Tinkoff.

If you have extra money that needs to be kept on a deposit or in investments (they are also taken into account), then putting it in Alfabank is quite a good idea. A reliable state bank with which nothing will happen. Thus, it will be possible to fulfill the conditions of free service and get buns in the form of 5% cashback and Priority Pass.