I have long wanted to write a post about a bank travel card with features: Tinkoff AllAirlines. Something about it is good, something is not very good, the reviews on the internet are very different. It’s even difficult to unambiguously advise her, although I use it myself and so far suits me. I will try to tell you all the nuances of what kind of card it is, what its pros and cons. Everything is as it is. And then you yourself decide whether you want to issue it or not. Let's get started.

The content of the article

- one Why is it all

- 2 pros

- 3 Minuses

- 4 How to spend AllAirlines miles

- five How to use the card correctly

- 6 AllAirlines Black Edition Card

Why is it all

As a preface. There are people like me who are interested in looking for great deals and making a profit from it. For example, a bank card with 2% cashback (what is cashback) for every 100 thousand rubles of spending, it brings 2000 rubles for free. If you spend 100 thousand every month, then this is already a gift of 24 thousand rubles a year. Not bad, and it's zero effort, essentially money out of nowhere.

Following the link, you can get 1000 rubles as a gift after the first purchase from 1000 rubles. And according to the action, everyone who spends 300 thousand rubles in 3 months will receive 5000 rubles. Everything is in miles, but then it is easy to compensate for them.

Checkout AllAirlines (gift 1000 rubles)>

I periodically test different bank cards and change them. Sometimes I write like this research posts. Yes, you can generally pick up a bunch of cards, each for its own category of purchases (gasoline, food, travel, etc.), but for me this is already too much. So I have 3-4 main cards and that's it..

I have been using the Tinkoff AllAirlines card all the time for the last year. As a result, it has now become my main card for Russia (ruble) and abroad. At the moment, I have already compensated tickets for 40 thousand rubles. And also I no longer need to buy travel insurance, as it is attached free of charge to the card.

It will be necessary to test other similar cards as well..

My review about the Tinkoff AllAirlines card

The courier brought with her the attributes of the traveler

pros

- Cashback 5% for the purchase of air tickets, 10% for booking hotels and cars, if all this is done on the website tinkoff.ru/travel. But hotels from Tinkoff Travel are the same Booking, so there is no difference.

- Cashback 3% for the purchase of an air ticket on any other website.

- Cashback 2% for all purchases in Russia and abroad.

- Free annual travel health insurance from Tinkoff (Europ Assistance). No limit on the number of trips, each trip up to 45 days. The insured amount is 50 thousand dollars. The policy must be renewed once a year. That is, insurance «eternal», until I closed the card.

- A good conversion rate for purchases in foreign currency (Central Bank rate + 2%) abroad. That is, due to 2% cashback, 0 losses are obtained.

- The card is made in a couple of days and it is brought to you directly home.

It would be possible to add to the pluses that credit card is convenient in itself, but there are plenty of credit cards on the market and this is not what a credit card can stand out with now. So the main advantages are cashback and insurance..

Actually, that's all. It looks good, but what is it really? Moving on to the cons.

Cashback is accumulated in a separate account in the form of miles

Minuses

- A tricky scheme to compensate for miles. You need to know it in advance, so as not to be disappointed later. About this below.

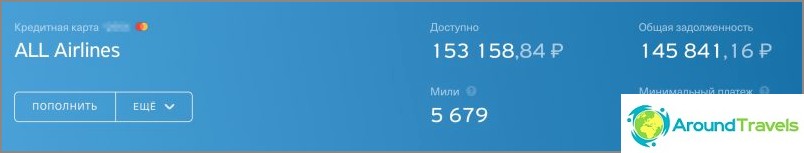

- The cost of annual maintenance is 1890 rubles or free if the expenses per month are more than 50 thousand rubles. In fact, this is a completely uncomplicated condition to fulfill. And on All Airlines debit it is free if the spending is from 20 thousand rubles. Also, you can ask the technical support to give you the first year for free. Do not hesitate, they don’t take money for demand. Consider a life hack, many are given. For me, the spending condition is easy to fulfill, so I don't consider this a disadvantage for myself at all..

- On the website tinkoff.ru/travel, the prices for air tickets may be higher than in other services, and the profitability is lost. Therefore, we always have 3% cashback for air tickets on any site, and 5% for air tickets is quite difficult to get, we must consider where it will be more profitable: buy tickets from Tinkoff and get miles, or buy immediately elsewhere. By the way, this year for 15 flights I have only 1 time (Moscow-Tel Aviv) tickets from Tinkoff were the cheapest.

- SMS notifications about operations cost 59 rubles per month.

How to spend AllAirlines miles

As I said, the main disadvantage is the compensation scheme.

All these cashback percentages are accrued in the form of miles, although this name is conditional, because 1 mile = 1 ruble. These miles are accumulated in a separate account and can ONLY be used to compensate for the purchase of air tickets. However, travelers fly more than once a year and they will have enough flights for subsequent compensation..

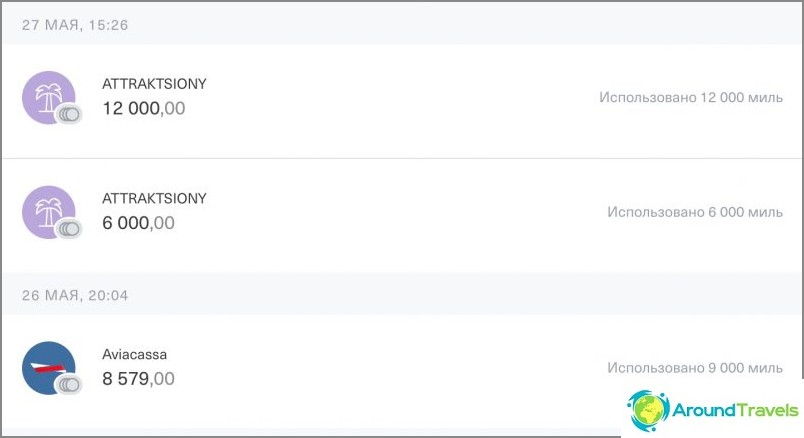

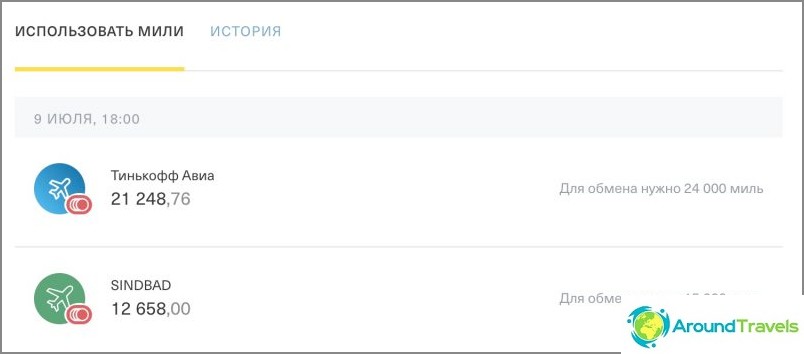

But the problem is how exactly the compensation takes place: at least 6,000 miles and only a multiple of 3,000 miles. For example, if you bought a ticket for 2,000 rubles and want to compensate for the purchase, then 6,000 miles will be debited. If the ticket cost 6100 rubles, then 9000 rubles will be debited. If the ticket cost 10,000 rubles, then 12,000 miles will be debited. You see what the catch is?

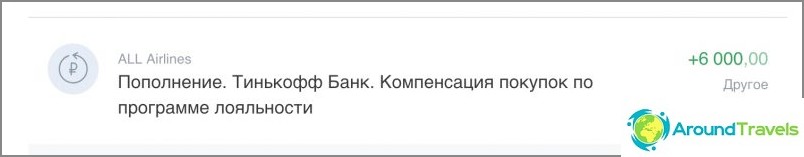

Now, when you understand the whole picture, it sounds worse. But I still manage to compensate very well. Below in the screenshots you can see that I almost did not lose anything, having compensated for 3 purchases. By the way, two of them are bungee jumps (69 meters and 207 meters), consider jumping for free. Nicely. But yes, the scheme with miles is so-so, so decide for yourself whether you need it or not..

Purchases already compensated by me (convenient amounts)

These amounts can be compensated, but it will burn a little too much

After compensation, the amount is credited to your account

How to use the card correctly

Gift of 1000 rubles for AllAirlines credit card>

Gift of 500 rubles for a debit of AllAirlines>

The last 2 points are the basic principle for using most credit cards. And that is why there are so many negative reviews about credit cards. They say that the percentages are high. Hmm. Guys who don't know how to use it, they don't need it. Who cannot control himself and always gets into debt - do not make a credit card, take a look at Tinkoff Airlines debit cards or debit cards of other banks.

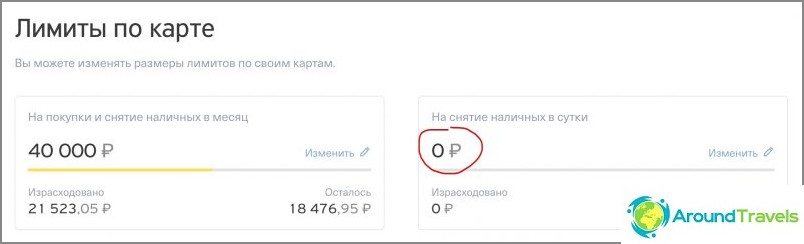

Disable debt insurance

Adjust the limits correctly

AllAirlines Black Edition Card

To simplify the compensation scheme, you can order more than just All Airlines, All Airlines Black Edition. It also happens, and credit, and debit. With such a premium card, miles will always be debited 1 to 1. You don't have to bother and win which ticket is better suited for compensation.

- Writing off miles to 1 to 1. Well, and the maximum number of miles per month can be 30,000 instead of 6,000. It will be relevant only for those who have large spending.

- Insurance is given for 100 thousand dollars for the whole family up to 5 people, including common-law spouses (few people give this) and minor children. Created directly from the mobile application.

- 2 free passes per calendar month to business lounges under the Lounge Key program, then 30 bucks per pass. Can be played with companions.

- SMS notifications are free.

The rest of the goodies, such as a concierge service and a personal manager, in fact, do not give anything, so I do not write them as advantages.

- For free annual service, you need to keep at least 3 million rubles on all accounts, including investments. Or spend a total of 200 thousand per month on any cards. In principle, if Tinkoff has a brokerage account and hold shares, then such a condition is already normal.

P.S. What travel maps should I still look at? I want to take one more for the test. May Opening «Travel»? First of all, the conversion rate in travel is important, and not just the size of the cashback.