Still, travel cancellation insurance applies more to travel on a tour. But if you are traveling on your own and want to arrange it, you can do it in person or online (for example, through the Cherehapa service). Although, of course, independent travelers have more room for maneuver - you can take return tickets, make unpaid hotel reservations, etc., so their cancellation insurance is much less relevant..

However, everyone's situations are different, so after reading the following text with an analysis of all the main questions, you can decide for yourself whether it is needed in your particular case and to what extent (some insurance companies take out visa denial as a separate item).

The content of the article

Travel cancellation insurance

Be sure to see my main post about insurance, compiled after analyzing a huge number of reviews and my personal experience (plus a little insider information). I try to update quickly so that you can always choose more working insurance.

Who needs it and what for

What is cancellation insurance and when is it needed? Usually it is bought together with a voucher abroad at a travel agency. Moreover, without even noticing this, since some tour operators immediately include it in the tour price, and in order to refuse it, you need to write a statement. Independent travelers rarely make such insurance..

Tour operators selling vouchers and tours abroad usually talk about the need to make travel cancellation insurance (although it can also be done when traveling in Russia). Large tour operators, such as Biblio Globus, Tez Tour or Pegas Turistik, advise their clients to always make this travel cancellation insurance. However, insurance companies try to minimize their costs and formulate insurance conditions so that most of the risks are not their responsibility. That is, in reality, insurance can work in rather rare cases. Therefore, some tourists prefer to save money at this point, considering the risks negligible. But nevertheless, when buying an expensive tour, or planning a costly independent trip, or taking into account your personal circumstances, you may nevertheless decide to make this insurance.

Travel cancellation insurance - is it necessary?

Travel cancellation insurance is most relevant if you are going to countries where you need to apply for a visa in advance to enter (first of all, these are the Schengen countries). You pay for the tour in advance or buy tickets yourself, book accommodation and suddenly you are denied a visa. Just in this case, you can hedge.

If you are going to a country where a visa is issued upon arrival or is not needed at all for a short-term stay (for example, Thailand), you, too, if you want to, can insure yourself against cancellation, because non-issuance of a visa by the embassy is not the only reason why the trip may be canceled ... About this below.

How much does the insurance cost, where and how is it issued?

Personally, I would rather take the travel insurance itself at a higher price, but for such options (insurance against not leaving, from an accident, from flight cancellation, etc.) would have scored. Moreover, even if I went on a tour, I would buy a separate travel insurance, since insurance from tour operators is usually so-so. I told in great detail about travel insurance and all the nuances associated with them in this post.

Of the documents for issuing an insurance policy, only a passport is required.

The cost of insurance depends on the total cost of your trip, usually from 1-5% of the tour price. Through tour operators, when buying a tour, travel cancellation insurance will be cheaper than when you buy a policy from an insurance company yourself, as an individual. The insurance conditions for all companies are different, some necessarily require a signed contract with a travel agency, others do not. Another typical condition for buying insurance is that it must be purchased at least a few days or even 2 weeks before the start of the tour, that is, in advance.

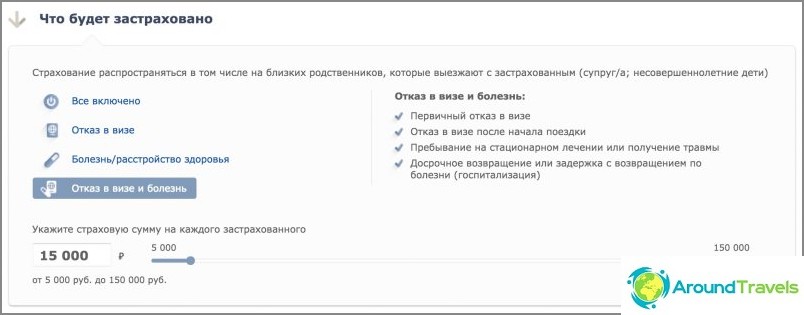

In case you are traveling on your own, you can estimate in advance the cost of traveller's health insurance using this online calculator, both with and without the option of insurance against no departure, and decide whether to add this option or not. The cost will vary depending on the amount of travel cancellation insurance (500-5000 ye), and the risk of visa refusal is selected as a separate item and also increases the cost of the policy. But you need to understand, since such insurance is usually offered by travel agencies, it can be bought directly from rare insurance companies. But I know that Ingosstrakh sells direct cancellation insurance.

In some insurance companies, you can choose what exactly to insure against: from visa denial, illness, or all together. The cost will naturally also differ, the more risks you insure, the more expensive the insurance. For example, from non-issuance of a visa with a minimum insured amount, pay 500 rubles, and for all risks with a maximum insured amount of 10,000 rubles.

What to do to receive payment, list of documents

The first thing to do after the occurrence of an insured event is to notify the insurance company about it. Usually, according to the contract, this must be done within 48 hours. The next step is to apply to the insurance company. In the application, you can indicate the number of your account, where the insurance must transfer money. You also need to collect the necessary documents confirming the occurrence of an insured event..

The list of documents for the insurance company (depending on the specific case) may include:

- An extract from the medical history;

- Death certificate;

- Police certificate confirming damage to property;

- A subpoena;

- Summons to the military registration and enlistment office;

- A copy of the visa refusal page;

- Documents confirming actual expenses (receipts, checks, etc.).

What the insurance includes and covers

This is perhaps one of the main questions. Because, if you figure it out, getting a cancellation insurance payment is not so easy..

The sum insured is paid only upon the occurrence of an insured event. The list of insured events is prescribed in the contract. Therefore, first of all, carefully read the contract. And remember that insurance in any case covers the cost of services, confirmed by documents, minus the cost of the insurance policy and the deductible (if any). Only actual, documented losses will be reimbursed. If a hotel reservation or tickets can be canceled free of charge, the insurance will not refund their cost.

In what cases are they usually paid

So what are the most often insured events in practice for travel cancellation insurance??

- Refusal of a visa (Schengen or any other) to the insured or one of his fellow travelers, if they are close relatives (parents, children, spouses, siblings). Only a few insurance companies will indemnify for damage if the travel companion of the insured who was not given a visa is not his close relative, but books one room with the insured.

- Illness or death of the policyholder or a close relative. In case of illness, only the hospital is considered an insured event, if you are sick and even injured, but do not lie in the hospital - the insurance is not paid.

- Damage to the property of the insured (due to fire, flood, theft, theft, etc.). But usually it should be a major damage, its amount is stipulated by the contract. Not all insurance companies include this clause in the policy.

- Summons to court (if at the time of purchase of the tour the insured did not know about this), summons to the military registration and enlistment office.

- Late obtaining a visa.

- Early return of a tourist from abroad in case of illness (subject to mandatory hospitalization) or death of his close relative. Not all insurance companies have.

What travel costs can be reimbursed by the insured in case of a proven occurrence of an insured event:

- Hotel accommodation

- Meals, including meals in case of delayed departure

- Air flight or railway travel

- Other types of transport

- Various prepaid services - excursions, tickets, etc..

But keep in mind that even with the onset of an insured event and after contacting the insurance company with the necessary package of supporting documents, the insurance company can sometimes still refuse to pay.

When are they usually NOT paid

- No compensation is provided for non-pecuniary damage.

- If the companion of the insured cannot travel, then most often the compensation is paid only on the condition that it is his close relative. The costs of returning back earlier or later than the travel date are not covered by all insurance companies.

- In some cases, tour operators may, when canceling a tour, impose fines stipulated by the contract for the provision of tourist services. Such expenses will be covered by cancellation insurance if this is expressly stated in the insurance contract or rules. At the same time, one-time payments and fees paid by a tourist are not reimbursed if they are not included in the package of tourist services. For example, consular fee when applying for a visa.

- In the case of illness, in most cases, only hospitalization and hospitalization are counted. Just a sick leave, including due to a fracture, for example, a leg, if you are not in the hospital, is not an insured event. Another nuance - if you have a chronic disease and you knew about it in advance, even in the event of hospitalization, this will not be considered an insured event.

- Natural disasters (tsunami, storm, volcanic eruption, etc.), any unrest and uprisings in the destination country are most often not considered an insured event.

- In case of any documentary problems: documents with false information or incomplete information are provided, or it will be revealed that the tourist has deliberately increased the amount of the loss, or the appeal to the insurance company was too late (the terms of application are established by the contract).

- The tourist was injured in a state of alcoholic, toxic or drug intoxication.

- Delay, postponement or cancellation of departure due to the fault of the carrier.

- In case of refusal of a Schengen or other visa, if the insured has previously had refusals. Also, some insurance companies do not reimburse the costs of a visa refusal if the documents for the embassy were incorrectly completed or filled out. It doesn't matter if the tourist filled out the documents on his own or with the help of a travel agency.

- Willful harm to health or suicide.

- Pregnancy.

P.S. In general, decide for yourself whether you need such insurance or an option or not..