Unfortunately, no one is really insured against an accident. But to mitigate the severity of its financial consequences, it is possible to insure. Especially if you are going on a trip and take your children with you. Of course, there are accident insurance for ordinary life, but it is during travel that the risk of meeting a not very pleasant surprise from fate increases greatly, so some people choose at least insurance for a child.

Although, on the other hand, as with all insurances in general, here you must first understand the conditions so as not to pay for the policy in vain. Let's try to figure out whether it is necessary to make accident insurance and what it gives.

The content of the article

Accident insurance

Be sure to see my main post about insurance, compiled after analyzing a huge number of reviews and my personal experience (plus a little insider information). I try to update quickly so that you can always choose more working insurance.

First, briefly about what it is and whether it needs to be done. And in the second half of the article, read the details..

What it is

Accident insurance is designed to alleviate financial losses in case of damage to health and life from unforeseen hazards. If we are talking about travel, then travel insurance (travel insurance) is purchased as an additional option in the form of a separate insurance with its own sum insured. That is, a visit to a doctor and a hospital in the hospital are paid on the basis of travel insurance and its insurance amount, and accident insurance implies an additional cash payment in case of any injury. And then you can spend this money wherever you want.

However, you need to know an important nuance when buying accident insurance - most often not the entire insured amount is paid, but a percentage that depends on the type of injury. The maximum amount of payments (100% of the insured amount) will be only in the event of the death of the insured (received by the heirs or the beneficiary specified in the contract). Therefore, do not think that if you are insured for $ 1000, then if you break your arm, you will get them all. No, interest will be paid depending on the severity of the injury, for example, only 10-20% of the insured amount can be paid for a leg / arm injury, that is, only $ 100-200 from $ 1000.

By the way, when you buy a train or plane ticket, they often sell you accident insurance along with it. This is a voluntary insurance and it is not always refused, because the price is low and many simply do not pay attention. Under this insurance, you can receive payments if an accident suddenly occurs. In exactly the same way, it can be sold and baggage loss insurance. Sometimes they are sold together, sometimes separately. Actually, if both of these insurances are already included as options in your main travel insurance for the entire trip, which you bought through the same Cherekhapa, then there is definitely no point in paying for them again.

Do I need to do it

Travel accident insurance may come in handy, but not everyone is willing to pay for it. This is an additional option, not mandatory, so the decision will only be yours. Whether you want to play it safe once again and pay money for it or not, you need a separate payment of money, or it will only be enough to cover the medical expenses under the usual traveller's health insurance.

The situation is the same as with life insurance when you are in Russia. Some people buy such insurance for themselves so that the family can receive financial assistance in the event of the loss of the breadwinner or loss of his ability to work. But this insurance product is not yet very popular in our country, because not everyone will be ready to bear additional financial costs. But you need to remember that in the case of travel, the risks increase..

Do I need accident insurance

All the nuances when buying accident insurance

What to consider when choosing insurance

- First of all, you choose NOT accident insurance, but travel travel insurance. Be sure to read my main post about travel insurance, where I told you what assistance is, which insurance company to choose, where to buy a policy, how to use insurance correctly, etc..

- Insurance companies generally consider an accident to be an event that occurs SUDDENLY and results in serious injury, illness, temporary disability, disability, or death. Injuries considered to be an insured event can be sustained in an accident, from an attack by a criminal, falling from a height, it can also be domestic injuries (for example, a burn with boiling water).

- As a rule, insured events are also situations that caused the death of the insured or the appointment of a disability within one year after the end of the insurance. All these terms are in the contract.

- If you decide to add an accident insurance option for yourself, then the most important thing you need to know is this. The injury that has occurred must be in the paytable. If it is not, then the insurance does not apply to this injury. Therefore, it is important to familiarize yourself with the table, asking to provide it to you explicitly, and in the event of an injury, keep in mind that the payment may depend on the wording of the diagnosis in your documents. In controversial cases, the insurance company will interpret the doctor's opinion in its favor, so it is better that it most closely matches the column in the payout table of your insurance company..

- Most of the standard programs do not cover accidents due to the consequences of pre-existing diseases (chronic diseases). Some insurance companies limit the amount of the sum insured, age, health status of the insured, etc..

- The amount of the sum insured for accident insurance is set at your request. The larger the amount of the insurance payment the insurance provides you, the more the payment for it will be. Therefore, it is important to maintain a balance so that insurance costs are not unreasonably high, but at the same time, the insurance payment is also not too small..

- You can insure both yourself and a family member: parent, wife, child. If you buy travel insurance for several people (family) at once and add an accident insurance option, then this option applies to everyone. To use this option for one person, for example, a child, you will need to issue him a separate policy with this option, and for the rest of the policy without an option. Since the option increases the cost of insurance, this way you can save.

When accident insurance doesn't work

When going to get insured, you need to understand that the contract contains a list of situations that will not be considered insured events:

- An event that occurred outside the territory and insurance period specified in the policy.

- Accidents that cannot be considered unforeseen are not included. For example, due to mental disorders in the insured, hypertension, chronic epilepsy, etc. The consequences of infectious diseases, strokes and heart attacks can also be included in the list of exclusions from insurance claims..

- Almost all insurance companies do not consider an insured event harm to health during force majeure - hostilities, civil unrest, strikes, etc..

- Often injuries during sports, including mountaineering and diving, are not counted. For those who are going to play sports while traveling, there are separate, more expensive insurance programs..

- If at the time of injury the insured was in a state of alcoholic, narcotic or toxic substances, if the insured suffered by committing criminal acts, in the event of death as a result of suicide or injuries sustained during an attempted suicide, if the insured was deliberately harmed.

The cost of insurance, the sum insured and the amount of payments

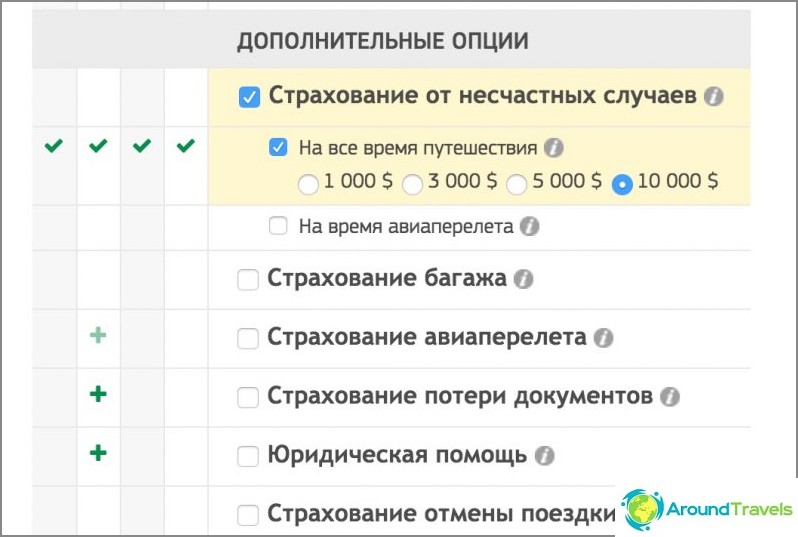

I would not buy insurance against accidents separately, since it does not replace medical travel insurance, in fact, on the basis of which medical assistance will be provided. Therefore, it is better to take accident insurance as an additional option to the main insurance. In this case, your travel insurance just gets a little more expensive. You can compare for yourself how the inclusion of various additional options in the Cherehapa calculator affects the price.

Accident insurance - additional option for additional money

The sum insured is determined by the insured, that is, you. If you choose online insurance, then, for example, the Cherehapa service (instructions on how to use) allows you to choose whether you want to insure for the entire trip or for the duration of the flight. In the screenshot above, you can see how it looks. You can choose the insured amount from $ 1,000 to $ 10,000. On the websites of some insurance companies, you can choose a larger amount. It is from the insured amount that the cost of insurance will depend and from this amount the payment will be calculated in the event of an accident..

Accident insurance payments are proportional to the damage to the health of the insured person. The more severe the injury and its consequences for health, the greater the insurance indemnity will be, which is paid either in a certain amount prescribed in the contract, or taking into account the period of incapacity for work. When the insured is hospitalized, payments from the insurance company are calculated in accordance with the contract, first, when being on treatment, this is one rate, if the duration of treatment in a medical institution is longer than prescribed in the contract, then this is a different rate, higher.

Examples of payments. With the second group of disability, you can get about 75% of the sum insured, with the third group - 50%, for a leg / hand injury, only 10–20% can be paid. Payment by «temporary disability» this is, as a rule, 0.2–0.3% of the insured amount for each day of incapacity for work, but the period of payments is usually limited to 60-100 days and insurance in such cases often use a temporary deductible - from 10 to 30 days, this period is not taken into account when calculating the insurance benefit ... For burns of 1-2 degrees, the rate may be 0.3% of the total amount of the insurance. For injuries to the face, neck, ears the tariff is 0.5%.

An example in figures from the websites of insurance companies, to make it clearer. If you insure a person for a period of 3 months in the amount of 200,000 rubles, then the cost of insurance will be 570 rubles. If, for example, there is a break on the basis of the payment table, the company pays 20,000 rubles - 10% of the insured amount. Another example. When buying an annual insurance policy (in the case of frequent trips) for 1 million rubles, its cost will be 7,000 rubles. Suppose, upon the occurrence of an insured event, the insured spent 5 days in intensive care, 14 days in a hospital and 30 days on outpatient treatment. Sum insured paid by the insurance company - 58,000 rubles.

Sequence of actions in the event of an accident

The first thing to do after an accident is to call the assistance (what is assistance) and find out which hospital you need to go to. If this is impossible (for example, unconscious), then the ambulance will decide for itself where to take. Medical assistance will be provided to you within the framework of travel insurance. As soon as an opportunity arises, you need to contact the assistance and resolve issues about staying in the current hospital, will they pay for the treatment right away, or they will have to pay on their own, and then receive a refund.

After you have resolved all the treatment issues, you can already think about paying in connection with an accident. You should notify the insurance (not assistance) about this and write a statement. The deadlines for submitting an application and the list of documents required to receive an insurance payment are indicated in the insurance contract and in the insurance rules attached to it. Usually, the need for payment must be reported no later than 30 days after returning home. Even if you cannot meet the deadline for submitting a written application, be sure to contact a company representative by phone, notify him of the incident and consult on how best to proceed. For reliability, it is better to immediately write down the name of the company representative with whom you spoke, the date and time of your call to the insurance company..

The application must be accompanied by official documents confirming that an accident has occurred with the insured person. The company representative, in turn, must register your application and provide you with its registration number, which will be useful in the future to simplify interaction with the insurance company. Using this number, you can find out the status of your application and provide the insurance company with additional information about your insured event.

The insurance company usually considers an application for payment within 1-2 months, calculates the amount of insurance payment and pays it to the client, if they have presented all the necessary documents and there are no circumstances refuting the occurrence of an insured event.

Documents required to receive payment

To receive compensation from the insurance company, it is very important, immediately after the occurrence of an accident, to correctly draw up and collect all the necessary documents, in addition to passports and the insurance policy itself. The list of documents can and should be requested from the insurance company. Usually it will be something like this:

- Accident report, an official document confirming the circumstances of the accident. With the signatures of all witnesses and responsible persons, if possible (original)

- A certificate from a doctor or honey. the institution that carried out the initial examination and provided first aid. The certificate must indicate the medical opinion and diagnosis

- During treatment - a certificate from an official medical institution, where the diagnosis and terms of treatment must be confirmed

- Prescriptions for medicines and receipts from pharmacies

- When establishing a disability, it is necessary to provide copies of the medical history and extracts from the outpatient and medical records, as well as documents confirming the connection between the accident and the assignment of a disability group

If the insurance payment is made upon the death of the insured person, you will additionally need:

- Original or notarized copy of the death certificate of the insured

- Identity document of the beneficiary (heir)

- Notarized copy of the inheritance certificate