Our family now has 3 Kukuruz cards and we have been using them for a long time. Even more, the cards were made as auxiliary ones for use abroad, and eventually became the main ones that we use everywhere. As you can see, I myself always use everything that I talk about here on the blog.

After a couple of years, it's time to write your own review based on personal experience. Moreover, the guys from Kukuruza decided to make a gift to each of our readers who decide to issue themselves the same card and enter our special promotional code in the mobile application. But more about everything below.

The content of the article

- one In general about Corn

- 2 Cashback and points

- 3 Debit and Credit Corn

- 4 Promotional code for Life-trip readers

In general about Corn

UPDATE. The ability to spend cashback points normally was removed from Kukuruza and the conditions were worsened. Of the advantages of the Central Bank rate. But in this regard, it is more profitable to use travel credit cards. Now I just have a spare corn, since it's free, I recommend having it just in case. And the main Tinkoff AllAirlines (via the link 1000 rubles as a gift), I also recommend.

UPDATE. The promotion is over. This post is not updated, therefore, for all the details on the conditions for obtaining a card and all tariffs, see here in this post.

I already did somehow selection of maps, suitable for travel, and in it Kukuruza took first place in my personal rating among ruble cards. Nothing has changed, it still remains there. All thanks to the exchange rate of the Central Bank, at which payment abroad becomes 2-5% cheaper than with other cards. Banks that offer the Central Bank rate for currency conversions can be counted on the fingers, on the fingers of one hand.

I will list all the goodies of the card:

- Free annual maintenance.

- Free SMS for all transactions.

- Issuing a card in Euroset, that is, you do not need to go anywhere, because Euroset is on every corner.

- The Central Bank rate for all operations in foreign currency (nothing is better than it). Very useful abroad and when paying on the same Aliexpress, the savings are significant.

- Cashback 1.5% on all transactions.

- Possibility to activate the service «Double benefit +» for 990 rubles / year and receive an increased cashback of 3%. Is there some more «Double benefit standard» (690 rubles for six months) and «Double benefit light» (290 rubles for 1 month), but IMHO they are less profitable.

- Possibility to activate the service «Interest on the balance» and receive 5% monthly. 259 rubles are frozen on the card, which are returned at the end of the deposit term.

- Also service «Interest on the balance» makes it possible to withdraw up to 30,000 rubles without a commission at any ATM (and if you need a larger amount, you can make a personal transfer).

- It is quite simple to obtain a credit limit from Tinkoff and Renaissance banks.

Payment in dollars, strictly at the rate of the Central Bank, commission 0 rubles.

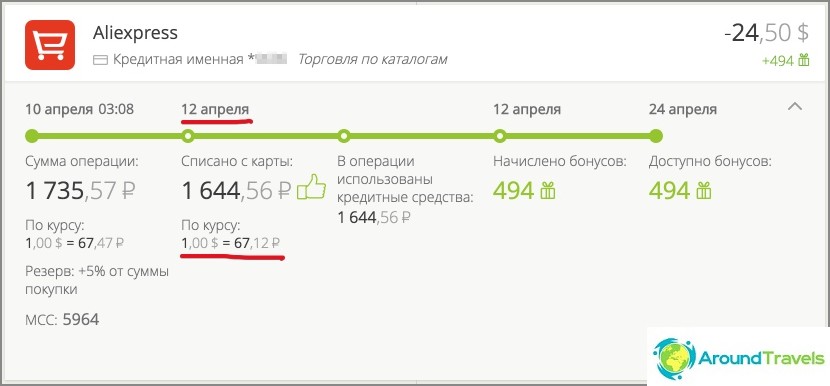

For reference, the Central Bank rate as of April 12, 2016 is 67.1250 rubles (calculated on the day of write-off). They wrote off $ 24.5 clearly at the rate of the Central Bank and gave another 3% cashback (494 points = 49 rubles). When paying in local tugriks, one conversion (USD => RUB) will also go at the rate of the Central Bank, the second conversion (tugriks => USD) will go at the rate of Mastercard. There are no commissions, that is, 0 rubles.

I will not mention the mobile application and the Internet bank, now everyone has them. Probably you are interested in cons? They also exist:

- Cashback is awarded with points that can be spent only in certain stores and the choice is not very large. I personally spend everything at TNK gas stations, Perekrestok stores and in Euroset, but this is not for everyone.

- Cashback conditions «Double benefit» worsened and now there is a restriction, double cashback is paid only within 30 thousand rubles per month, if this amount is exceeded, only the standard 1.5%. They do not pay cashback for the purchase of household appliances and electronics (except Aliexpress and a number of stores). Crisis, his mother! But in fairness, many of the banking products that I used have deteriorated: Tinkoff ladders, Homecredit credit cards, etc..

- Kukuruza does not have its own ATMs in Russia, so if the service is not connected «Interest on the balance» or you need to withdraw more than 30 thousand / month from an ATM, there will be a commission of 1%. Since ATMs with someone else's cards often have a limit of 5-10 thousand rubles per withdrawal, you will have to withdraw a large amount in several approaches. Abroad, such a minus does not matter, since there will be a withdrawal fee for most Russian cards.

Cashback and points

I agree that linking to certain stores is not very convenient, and for me this is the most significant disadvantage. But there are very few similar offers on the market, so that 3% for any operations, and at the same time, maintenance costs are 990 rubles per year. Usually, cashback is offered about 1%, there is a fee for an annual service of 500-1000 rubles, and also separately for text messages of 50 rubles per month (600 per year). For those who have enough cashback of 1.5%, the card will be released completely free. As I already said, there are practically no cards with the Central Bank exchange rate for foreign countries. The only thing is, they say that some sellers at the points may try to impose on you the connection of a particular service, but I myself haven’t come across this myself, but I have already received 3 cards in different places. And there is still such a life hack.

Lifehack: If, when receiving a World card in Euroset, you will be forced to connect to any service, then take the usual Mastercard Standart without the World prefix, it may be more readily issued without additional services. And then you yourself order your MasterCard World PayPass card in your personal account. In any case, a personalized card is preferable when it comes to trips abroad..

From personal experience. I returned from Thailand with almost 15,000 rubles of cashback in total for 3 cards. All tickets, hotels, apartments, car rental, and purchases in the supermarket, I paid with the Corn card. This number of points has accumulated in about six months (a trip to Russia + Tai). Thus, I have already recouped the costs of the connected service 10 times. «Double benefit», and the year is not over yet, as I connected it. Maybe for someone 15 thousand rubles is nonsense, but I really like that now I will be refueling with gasoline for free for several months. Well, more precisely, not for free, since at TNK now you can pay with points only 50% of gasoline. But it doesn't hover for me, I'll just spend a little longer bonuses.

You see, the most important feature of all this my troubles with cards and cashbacks (one card for one, another for another) is that the once chosen scheme of storing funds and their spending brings a good profit per year, despite the fact that I don’t have time for this. spend.

6700 rubles for one Corn card, 4600 rubles for the second

Do you know when I felt fully that points are real money? When I bought a router in Euroset. I just came to Euroset, took the router and paid nothing. Not a penny. Only the points were deducted from the card. That is, you live for yourself, you do nothing, you just spend money on your usual purchases, and the bonuses accumulate by themselves, and then they are exchanged for real goods. But in general, of course, this is not the essence of points, but of any cashback. Money from nothing. The main thing is to pay with a card everywhere (and I have always done and do this), and control your expenses, that is, not to increase them for the sake of cashback. About cashback on cards I have a separate post.

A router bought in Euroset for points

Debit and Credit Corn

I also wanted to mention separately how Corn became my main card. I'll start from afar.

A couple of years ago I met people who optimized their banking products and lived on interest from deposits. This topic seemed very interesting to me, even though I had no money for a substantial deposit at that time. It is logical that the account must have a minimum of several million in order for the interest to be sufficient for living. Nevertheless, I decided to look into the issue and found out that there are cards with free service, there are cashbacks, there are cards without commissions when paying for purchases abroad. At first I made myself a bunch of cards (10 pieces), and then I realized that the topic, although interesting, but constantly monitor changes (tariffs, categories of increased cashback, etc.), and also keep in mind which card when to pay, not for me. I wanted a universal card. As a result, having made Corn for abroad and using it, I realized that it is quite possible and necessary to use it in Russia. The same more or less universal card for spending, from ruble.

To withdraw cash, I have a Sberbank card, ATMs in each district, a limit of 150 thousand rubles per day for withdrawals, more than. I would gladly get rid of it (the service is so-so), but most people in Russia have it, and it can be very convenient to transfer money to someone. To store funds, you can use Tinkoff deposits and their cards. As a result, there are 3 cards for all occasions and a very simple scheme.

Not so long ago I made myself another Maize credit card. Previously, I often used a Homcredit credit card, but conditions there worsened, so I had to change. Why do we need credit cards, I have already written, as well as how to use them correctly. Yes, credit card is generally completely optional, but I'm used to it. Moreover, when it is issued for 1 month, the service is given free of charge «Double benefit +».

Promotional code for Life-trip readers

UPDATE. The promotion is over. This post is not updated, therefore, for all the details on the conditions for obtaining a card and all tariffs, see here in this post.

Now you have the opportunity to get 500 rubles for free. A trifle, but nice. To do this, you need to issue a card and fulfill simple conditions. Details on the promotion page. I will list the main things:

1. Apply for a card in Euroset (this should be your first Kukuruza card, you are a new client).

2. Install the mobile app «Corn» for iOS or Android and enter the promo code: LIFETRIP (note that the promo code is written without a hyphen and with a capital letter).

3. Pay by card for any purchase.

4. Get 5000 points to your bonus account! (5000 points = 500 rubles)

Further within a month will be credited «welcome bonuses 5000». So for those who thought to issue a card, this offer will be just right. Please note, the offer is available until July 31, 2016.

P.S. If you have any questions, ask.