I constantly monitor a couple of topics on the banking forum, where various cards for travel are discussed. I decided to write a separate big review about the Corn card from Euroset, which I advised in my a selection of maps for travel. I think it should be done by everyone who is going to go abroad, even just in case, because it is free, and conversions are at the rate of the Central Bank!

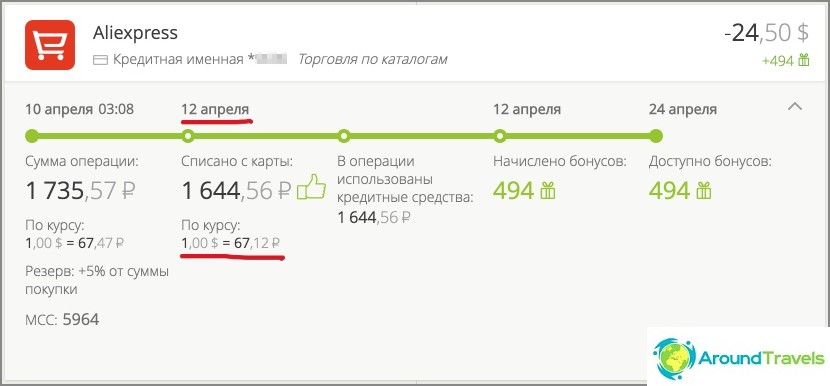

However, it can also be suitable for spending in Russia, if you do not chase cashback, since service and SMS are free, and when paying in foreign online stores like Aliexpress, you can save with it (how to do it right).

The content of the article

Corn Map

How to get a Kukuruza card

UPDATE. They removed the ability to normally spend cashback points and worsened the conditions. Of the advantages of the Central Bank rate. But in this regard, it is more profitable to use travel credit cards. Now I just have a spare corn, since it's free, I recommend having it just in case. And the main Tinkoff AllAirlines (via the link 1000 rubles as a gift), I also recommend.

After receiving the card, install the mobile application and enter my promo code FRASFM38V. Then you will receive 300 rubles to your account.

1. You can easily get the card in Euroset on the day you apply, you only need a passport. You can immediately receive two types of unnamed cards: Mastercard Standard and Mastercard World. The standard one costs 0 rubles, and World is issued for 200 rubles. If you immediately activate the service «Double benefit», then pay only for it (990/290 rubles), without 200 rubles. The difference between the Standard and World cards is in the amount of cashback, for the usual 0.5%, for World 1.5%. Both unnamed!

2. Further in your personal account, having any of the cards, you can order a personalized MasterCard World PayPass, it will be with a chip and, accordingly, PayPass. Cashback for it is 1.5%, and it doesn't matter what card you had in your hands initially.

Of site

Personal Area

Lifehack: If, when receiving a World card in Euroset, you will be forced to connect to any service, then take the usual Mastercard Standart without the World prefix, it may be more readily issued without additional services. And then you yourself order your MasterCard World PayPass card in your personal account. In any case, a personalized card is preferable when it comes to trips abroad..

Name card Kukuruza with chip and PayPass

It is very advisable to order a personal card so that later it would be easier to pay abroad. Nameless workers, too, but there were times when they were refused to accept. Therefore, if you have time before the trip, order a personalized one, there is no time - go with an unnamed one. After activating the nominal, the unnamed is blocked.

The cost of delivery of a personalized card by Russian post is 200 rubles (starts from 4 days).

Pony express delivery cost - 750 rubles (takes 1-2 business days).

About the map

The card issuer is a Settlement Non-Bank Credit Organization (RNCO) «Payment Center», that is, no bank serves the card, it is not a bank. Therefore, in the event of bankruptcy, the DIA will not help you and the money will be lost. But there is a way out, or rather, even two.

- Do not keep funds on it, transferred a little and immediately spend / withdraw.

- You can and should connect the service: 3-6% on the balance on the card and no commission for withdrawing from an ATM within 50 thousand rubles / month. The service is connected to Euroset. In this case, the amount on the card is regarded as a deposit in Otkritie Bank (formerly Promsvyazbank), and this deposit will be insured by the DIA! When the service is activated, 259 rubles are frozen on the account.

Conditions and rates

- Free annual service. Free SMS-informing on all transactions. There is a mobile application.

- The service life of the card is 5 years. Convenient for those who leave for a long time, because other cards are given only for 2-3 years.

- Cashback for all purchases with the card 0.5-1.5%, or 3% when the service is connected «Double benefit +» (990 rubles for the whole year). Is there some more «Double benefit standard» (3% cashback for 690 rubles for six months) and «Double benefit light» (3% cashback for 290 rubles for 1 month), but IMHO they don't make much sense. An increased commission of 3% is charged only up to the amount of purchases of 30 thousand rubles / month. Details about, what is cashback, I already wrote, read if you don't know.

- When connecting the service «Roadside assistance» you can get 5% points at gas stations all over the world. The cost is 990 rubles / year. You can spend 0-7000 rubles per month in total, then it will be standard 1.5% to be charged.

- A credit limit from banks TCS (easier) or Renaissance can be issued to the card. Cards with a credit limit have 3% cashback during the first 12 months.

- Conversion when paying in foreign currency occurs at the exchange rate of the Central Bank. This is true both for overseas trips and for purchases in foreign online stores, such as Aliexpress. If you do not know yet, then it is better to pay there in dollars, not in rubles and use Corn for this. More details, how to save 11% on Aliexpress.

- Service «interest on the balance» gives 3-6% on the balance on the card: 3% if the card has from 15,000 to 299,000 rubles; 4% if the card is available from 300,000 to 499,999 rubles; 5% in case of availability on the card from 500,000 to 999,999 rubles; 6% if there are 1 million or more on the card. Interest is calculated daily on the current balance at the beginning of the day. When the service is connected, you need to keep at least 5,000 rubles on the card every day for the whole month or make transactions for 5,000 rubles per month, otherwise a service fee of 70 rubles / month will be charged. Fireproof amount freezes on the account 259 rubles.

- Commission for withdrawal from ATM 1%, but not less than 100 rubles. That is, you need to withdraw at least 10 thousand rubles or the equivalent in foreign currency. And if you activate the service «interest on the balance», then up to 50,000 rubles / month rubles, but from 5,000 rubles for each withdrawal, the operation will be commission-free.

- Commission for withdrawal at the bank's cash desk 4%, but not less than 350 rubles. Note! In Thailand, some shoot at the box office, this card is not suitable for this.

- For cards with a credit limit and registered PayPas World cards, the maximum balance is 600 thousand rubles. The maximum balance of unnamed cards is 100 thousand rubles.

- The maximum amount of replenishment from the linked card in the personal account of Kukuruza is 550 thousand rubles per month, and 125 thousand rubles for one time. Transfer from one Kukuruza to another is instant, the limit is 150 thousand rubles per month, no commission. Moneysend to other cards 1%, limit 125 thousand for 1 time, only 550 thousand per month. More about all limits.

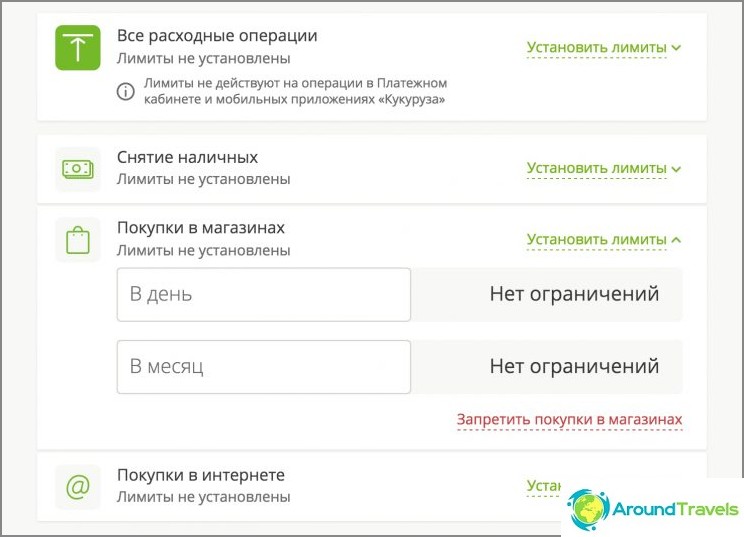

- You can set limits for any card transactions in your personal account of Kukuruza.

Limits on operations in the Personal Account and on the card

Payment and withdrawal of cash at the exchange rate of the Central Bank

I took it out separately, since this is the most important feature of the card.

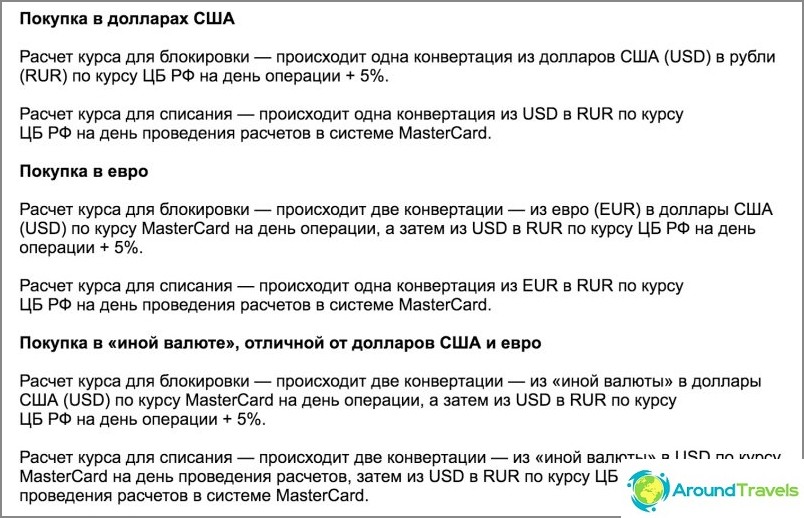

The calculation goes through USD and EUR, that is, the schemes will differ depending on where is what local currency.

- If the currency is dollars, then USD => RUB

- If the currency is Euro, then EUR => RUB

- If the currency is tugriks, then tugriks => USD => RUB

By tugriks I mean all currencies, except for the euro and the dollar - zloty, baht, kroons, pounds, etc. Now there are not so many cards on the market that use the Central Bank rate, usually the internal one is much worse than the Central Bank. Writing off usually occurs in 2-3 days, but they can keep the operation for a week. At the time of payment, the amount is frozen at the rate of the Central Bank + 5%. Below in the screenshot in more detail, specially copied from the official site, otherwise the devil will break his leg to find something.

Operations at the Central Bank rate on the Corn card

Payment in dollars, strictly at the rate of the Central Bank, commission 0 rubles.

USD and EUR currency wallets

You can buy yourself dollars or euros at any time, which will be stored in these wallets. You cannot pay with this currency, transfer it anywhere too. It can only be transferred back to rubles, or stored, or received in cash. The functionality is limited, but once it was not. But now it is possible to buy in foreign currency at a rate close to the exchange rate. Or buy when the currency falls and sell when it rises. Although for an ordinary user, the last option is doubtful, therefore, rather, for storing and receiving cash, you can use.

- The rate is close to the exchange rate and changes throughout the day.

- Wallets do not fall under the DIA.

- Currency can only be received by the owner of the Kukuruza card here in the list of these banks.

How to use the card

How to replenish the Kukuruza card

1. You can top up in cash in Euroset. As far as I know, replenishment is only possible personally, that is, a third party will not be able to replenish your card. But a third party can get himself a Corn card and transfer from it to your card.

2. But the easiest way is to replenish from other bank cards in the personal account of Kukuruza. It is in your personal account and from the linked card, then there will be no commission. I can say for sure that you can replenish without a commission from Sberbank cards and from a Tinkoff Black card (from 3000 rubles), it is verified. Instant replenishment.

3. Replenishment by traditional interbank transfer is also available. The interbank runs as standard up to three business days. The card account details are in your personal account.

4. And of course, you can transfer to a card via Moneysend (transfer from card to card). But, as a rule, such a transfer is subject to a commission of 1-2% (depending on the bank of the outgoing card), so it is not needed when there is method number 2.

How to withdraw money from Corn without commission

- The easiest way to withdraw commission-free is by interbank transfers from the Kukuruza card to the accounts of Russian banks. Once there was no such way, but now the card does not differ much from other bank cards. Limit 100 thousand rubles per month without commission, then 0.5% (but not less than 20 rubles and not more than 1000 rubles).

- The next way is to send a money transfer Zolotaya Korona to your name from your personal account, then you can withdraw up to 150 thousand / month in Euroset for free.

- You can also use the Moneysend Card to Card service, that is, transfer from card to card, this is a slightly different mechanism and it is often subject to a commission. Moreover, such a service is available both in the personal account of Kukuruza (1% commission), and most likely in the Internet bank of your other bank card (the commission depends on the bank). So, when transferring to Tinkoff Black, Tinkoff himself does not take a commission within 300 thousand rubles.

- Another option to withdraw money from Kukuruza is to use the loan repayment option, which is located in Kukuruza's personal account in New payment / Repayment of loans. Previously, it was possible to withdraw to the usual Tinkoff without a commission, but Tinkoff began to take a commission for this operation. I will not tell about other banks.

Where and how to spend points

UPDATE. Points cannot be spent on TNK since July 2016.

Points expire after 9 months of no card transactions.

Unfortunately, cashback is credited not with money, but with points, and it is quite difficult to use them now, unlike the same Tinkoff card, where cashback simply falls in rubles to the balance. So, you can write off points from Kukuruza only when shopping in Euroset (99% of a purchase), in Perekrestok stores (30% of a purchase), in Doctor Stoletov pharmacies (99% of a purchase) and in a number of little popular organizations: Liters, Softkey, Pro-Service and Alavar.

To avoid confusion, they finally did that 1 point = 1 ruble.

I have on one card Corn 6700 rubles in points, on the other 4600

For such MCC codes, Kukuruza does not award points

I stopped using the card, as earlier it was possible to spend on TNK. And I very rarely go to the Crossroads, and even less often to Doctor Stoletov. When you are abroad, there is nowhere to spend points, so you need to accumulate them and wait until Russia.

P.S. The Kukuruz card is now just a spare card, just in case, since it's free (I keep 5-7 thousand rubles on it so that they don't charge for service).