Despite the fact that my site is geared towards travel, I am still an individual entrepreneur. Since I try to constantly share my personal experience, I hope this post will be useful to someone. I have an individual entrepreneur without hired employees and I work on the simplified tax system. Therefore, from the very beginning of my activity, I did not consider large banks with a large monthly service fee and a bunch of services. I just don't need it. In a month, I receive several incoming payments from counterparties and I make a couple of outgoing transfers to my individual account. It may well be that someday I will have workers and other services will be needed, but not now.

The content of the article

Previous experience

I opened my first account with SB Bank, then with iBank, then with Tinkoff. The first 2 banks went into oblivion after the license was revoked, Tinkoff is still alive. Also, as an individual, I have used or still use the services of Tinkoff, Sberbank, Avangard, Kukuruza, Homecredit, MKB, Alfabank. This I mean that I have already seen enough Internet banks and talked with technical support of various banks - there is something to compare.

1.5 years ago I opened a current account in Modulbank, I urgently needed an account for foreign exchange earnings. Banks usually always have a commission for maintaining an account. And when you have 3 of them (rubles, dollars, euros), then even 500 rubles for each account already turn into 1,500 rubles per month or 18,000 per year. It is clear that for business, this is not a very large amount, but somehow I got used to using banks for free or almost free of charge: I keep my money with them, which they twist until I withdraw it. This applies not only to the settlement accounts of individual entrepreneurs, but also to the personal accounts of individuals. Even though I have more than 10 debit cards, I pay almost nowhere for an annual service, otherwise it would be very expensive.

Modulbank was initially considered by me as a temporary solution until I choose a more famous bank. However, after a year and a half, I still use it. Moreover, not only foreign currency accounts, but also ruble ones. So let's say, now I have become a regular customer of Modulbank.

Available services of Modulbank

My review about Modulbank

My rate for 490 rubles / month

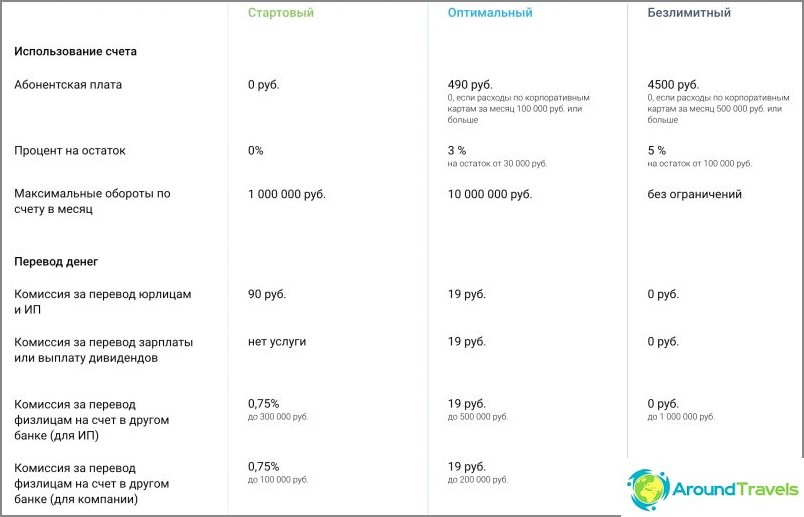

Now my tariff is Optimal, it is average in the line (there are 3 of them). In my opinion, it is the most convenient and inexpensive for entrepreneurs with small and medium individual entrepreneurs, with incomes of up to 500 thousand rubles per month. It costs 490 rubles per month, while this amount includes several accounts in different currencies (rubles, dollars, euros, yuan). Any payment order costs only 19 rubles. For me, this is 490 rubles per month for the tariff «Optimal» quite acceptable service fee - optimal 🙂

Comparison of bank tariffs for business>

There is also a free plan «Starting», but for me, the rates are not very good there. Payments to legal entities - 90 rubles, and to individuals - 0.75% of the transfer amount for outgoing transfers (but at least 90 rubles) within 300 thousand rubles per month, then the commission grows. This is only suitable for those who make 1 outgoing transfer, every few months, and not like me for 2-3. In general, the tariff «Starting» I would not consider. And for legal entities with a large number of payments, you should already consider «Unlimited». It is convenient that there are few tariffs, only 3 and they are all clear.

Modulbank tariffs for current accounts - my «Optimal»

At each tariff, sms are free and they always contain information from whom the money came. I have an application from Drebedengi, which, by this name of the counterparty, recognizes this or that receipt and adds it to various income items (I have everything in detail). Hello Tinkoff! For whom SMS is paid and there is no such information, receipts have to be entered manually.

Naturally, at any tariff you can use bank cards, in my tariff they issue 2 cards. I will not list the tariffs, it is better to look at the official website of Modulbank, especially since I do not use cards, I do not need them. Most freelancers like me, it seems to me, only use interbank transfers. It is much easier to transfer an individual to your card in another bank and then dispose of them according to the usual schemes: pay for purchases, withdraw from an ATM.

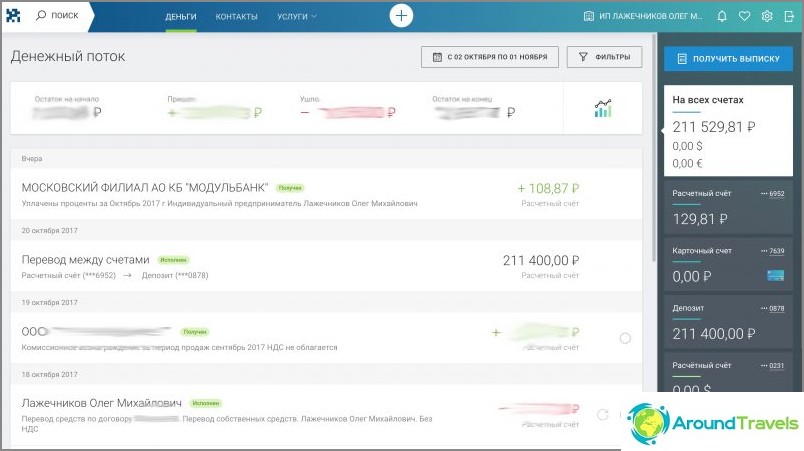

Recently I put a couple of hundred on a deposit at 7.5% (90 days), which is quite a normal rate for IP funds that are temporarily not needed. Below in the screenshot you can see this deposit, it is in a separate account, everything is on the machine - I just wrote in the chat that I want a deposit for such and such an amount, and they created this deposit account for me. I don’t know if it’s necessary to notify about deposit accounts now (you don’t need regular settlement accounts), but they do it themselves anyway.

But what I think one day to use - an accountant for an individual entrepreneur, I will decide to change my online accounting. There is even a free tariff, and the paid tariffs are comparable to the My Business service, which I use right now. By the way, Module bank clients are given 3 free months to try My Business. Synchronization between the bank and My Case works fine, at least I haven't had any failures yet.

Free service promotions

Modulbank has a free service promotion at any tariff, as long as you try the services at the very beginning for 30 days. And if something does not suit you and you close the account, then you can refuse service without paying the tariff. There is one more action that duplicates this one a little..

Promotion for those who have already become clients of the bank - Give a Friend a Bank. It gives 1 month for free at any tariff to everyone who draws up an invoice at your invitation (click on your link). And also you yourself also get 1 free month of service. A trifle, but nice. As soon as I tasted the bank, I started recommending it to all my friends. Really, it is not a shame to advise it, and I would use it even without this promotion. I do not argue that there are banks that are more suitable for you personally, but so far everything suits me. But you can issue an invoice using my link if you are a new client. Then I will receive a bonus, you will receive a bonus, and then you will already recommend your friends.

Support and services

Honestly, I would not say that they now have some outstanding tariffs, but I liked how the bank and technical support work. Starting with the fact that I only once went to the office to conclude a contract (everything is free), ending with the fact that I never had to solve any problems or call them on the phone. It's horrible how I hate the phone, it's especially inconvenient when you are often abroad. By the way, now you don't have to go anywhere to conclude a contract, they themselves come to you.

All communication with technical support takes place in the online chat inside the Internet bank. During business hours, they answer questions pretty quickly, almost immediately. For comparison: I often had to call up with iBank, and at Tinkoff I had to wait a long time for an answer in the chat. Well, Tinkoff has recently begun to support stupidity, either in the bank for individual entrepreneurs or for individuals. It's a shame it didn't happen before.

Of course, the Internet bank itself is also important, for example, Tinkoff has some functions hidden so that you cannot find it, and the Avangard has just an ancient interface. So the Internet bank of the Module is quite modern. There is a mobile application that has chat and translations (regular and favorites). I have been using the app more often lately. Conveniently, you enter with your fingerprint (no need to enter usernames and passwords) and then any operation is confirmed by SMS, which is recognized by the application itself (no need to enter numbers). These are all little things, of course, and now all banks that I use have normal applications, but I just list it.

Internet bank in Modulbank

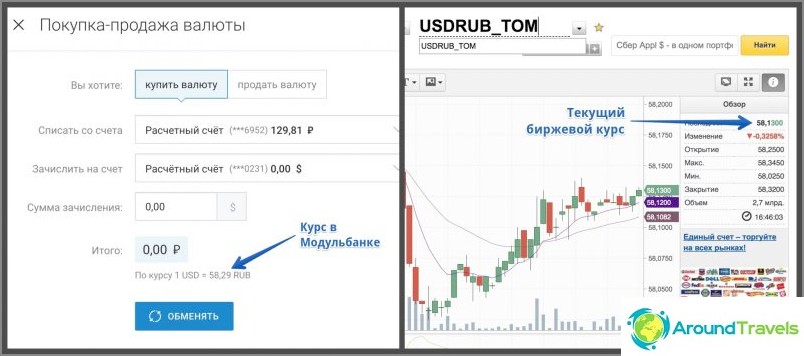

From the useful, but what I myself rarely use - a good exchange rate. During business hours, it is close to the stock exchange. Usually I try to leave the currency in currency and then withdraw it to my foreign currency account of an individual, but when rubles are needed, you can exchange currency for rubles right here.

Specially made screenshots of courses at the same time

The White Business system has recently become available. Quite an interesting thing that may be needed by some entrepreneurs and firms, especially when now there are blocking of current accounts in many banks. The system will allow you to avoid blocking the account by predicting risks and recommendations for their mitigation. She will monitor 17 key risks due to which a business is usually closed an account. These include the percentage of taxes on turnover, the cleanliness of the counterparties with whom the company works, the number and volumes of transfers to individuals, cash withdrawals, etc. Then each client will receive clear recommendations to reduce the identified risks. Didn't try it myself

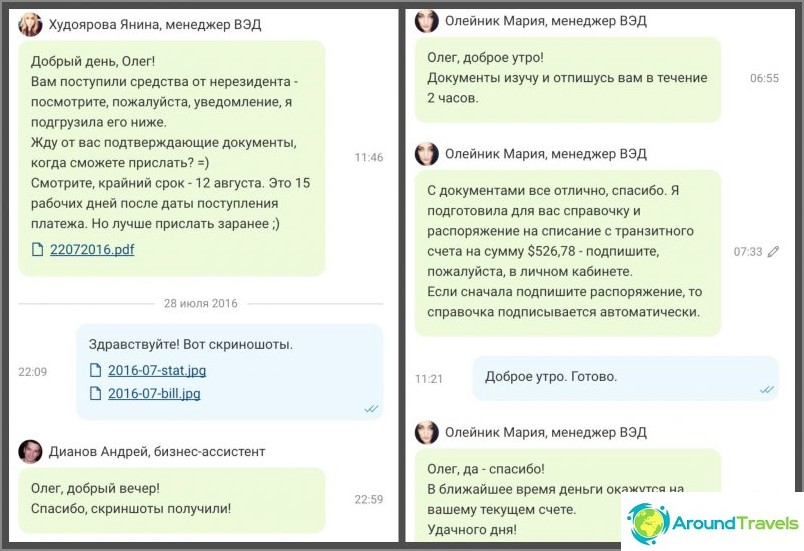

Foreign exchange control

Separately, I would like to mention how the currency control and payment for foreign partner programs are going on, with which many webmasters like me cooperate. Since the payment is made not according to an ordinary paper contract, but according to an offer, you do not have one «normal» pieces of paper. There is only an offer on the site and screenshots with payments from your personal account. So in the Module, it is enough to send a scan of the offer with your signature and screenshots from your personal account to the online chat. A bank employee makes a certificate of a currency transaction and an order to transfer from a transit account to a currency settlement account. The only thing left to do in the Internet Bank is to confirm the transaction by SMS. This is great! And they take only 300 rubles in a fixed amount for foreign exchange payments up to 500 thousand rubles (equivalent in foreign currency).

Immediately I remember the execution of a currency payment in iBank, where I constantly made mistakes, which is why they called me from the currency control and asked to correct everything. The only drawback of the Module is that their correspondent bank takes a commission of 5 ye for a currency payment (it used to be 25 ye). Although, if the payment is at least $ 1000, then this is only 0.5% (half a percent), which is very little in reality.

Currency control is carried out in the chat

P.S. Write questions, I will tell you what I know in terms of Internet banking or something else. I do not argue that someone may have problems or someone does not like the Module, but for the time being, everything suits me and I can recommend it. So let's say, I always recommend only what I myself use.