Today I want to share my principle of managing the family budget as a whole, because it does not matter what kind of budget you are running, family or for travel, the principle itself is important, which can bring closer or postpone the possibility of your travel, savings, financial freedom.

I often come across the fact that people do not know where they spend their money, do not know how much they spend on food, for gatherings in a cafe with friends, for clothes, for unforeseen expenses, and so on. At the same time, they borrow money, complain that they do not have enough money, and so they want to go somewhere, or buy a laptop / bicycle ... The question immediately arises, do you really want to? Or, what do you want more, squander money on beer on weekends, or go to the sea? Of course, at sea, but I spend so little on entertainment, there will be an answer. In reality, a person does not know that some of his expense items in total for several months or a year make up a trip to the sea..

The content of the article

Why do you need to keep a budget

I in no way urge you to save on what is important to you. But it's better to know and understand how much money it actually takes from you so that you can make an informed choice. No less important is the knowledge of your real desires, your real dreams. I wrote about this in the article How to change your life for the better or what prevents you from traveling.

You have a lever of pressure on your family members 🙂 For example, a wife comes to her husband and says, here we are not buying me anything, we are not spoiling me, and you bought yourself a MacBook for 50 thousand, ah-ah. Silently, the husband opens the budget, makes a sample for the year and shows that apart from the MacBook, he only bought a couple of T-shirts for himself during the year, while the wife has already collected 100 thousand clothes for the whole year, just not everything at once, but gradually bought , periodically.

pros

In general, the budget is a great thing for understanding how your spending stacks up. In reality, many people think that you will think only 1000 rubles more, but in fact, these thousands of rubles for the whole year (and for someone in a month) so much accumulates that you can buy a car! Toy 🙂 In fact, I'm not kidding, saving the family budget is the only way it develops - from little things, this is the main feature. The saved 1000 rubles = 1000 rubles earned. Recently I calculated that my smoking friend spends about the cost of a good laptop on cigarettes a year. That is, if he did not smoke, he could change the laptop once a year.

But I beg you not to confuse economy with beggarly. Trying to increase your earnings is a necessary and obligatory desire, and in no way contradicts saving. As in business, there is always an accountant who optimizes costs. And, if you go in two directions at the same time, earning, and consciously filtering out unnecessary expenses, you can come to your goal much faster..

I sincerely do not understand the situation when requests grow faster than income. That's the point of spending everything and getting into debt / loans, for what? Isn't it better to postpone or invest to gain financial independence and freedom? Otherwise, you can earn millions, but all the same «beg».

So, the pluses point by point.

- The control. You always clearly know what you are spending your money on. There are no questions, but where did half of the salary go, and who spent it?.

- Conscious choice. After a couple of months of budgeting, you really know how much each item of expenditure is, and you may very well want to adjust it (decrease / increase). Thus, unnecessary waste is eliminated..

- No debt. Getting into debt / loans is minimized, because everything can be calculated in advance and avoided.

- Easier to plan your purchases. Whether you want to buy something big or go somewhere, it's much easier to plan with a budget. You can find out in which month you will have a sufficient amount, which is very convenient, or how you need to change the structure of spending so that this amount appears.

- Useful for long journeys. You can always plan in advance how many months the money will last.

- Convenient for getting fired. You can find out how much time you have and calculate when it is time to start looking for a job..

- Disciplines. And in terms of spending, and in terms of life in general.

I've been budgeting since 2008. I tried it once and I liked it. Thanks to the budget, it was possible to plan more than one trip, or rather to understand the possibility of its implementation in a specific month under specific conditions. He also helped me a lot after my dismissal in 2010..

I then immediately calculated how many months of free life I can get, which countries to go and what things to buy. Accordingly, I knew in what month the earnings would have to appear or when I had to go to work (in case of failure).

In general, I like the feeling of security / safety most of all, when you can plan everything in advance (for 3-6-12 months) and be calm.

Minuses

There are (for me) much less of them.

- Noticing spending and planning a family budget takes time. With the right approach, very little, but it takes. But sometimes it’s even nice to take it, but write out a plan for the next six months and add useful purchases and long-awaited trips there..

- There is a chance to get stuck on economy and go over some acceptable boundaries Or otherwise, become a curmudgeon, starting to save on everything in general. It should be understood that everyone has their own boundaries, that for one saving, then for another - squandering.

- Addition to the previous point. There is a chance to stick to the current level of income and focus only on saving. Or else, «do not allow» have more money for yourself, a kind of psychological barrier can be obtained.

How to manage a family budget

As I wrote above, the basic principles (well, or pluses) are spending control, conscious choice and elimination of unnecessary expenses. And the budget is built on this: you plan spending for the required period of time and then stick to it. Also, in the process, you need to mark these expenses in order to correlate the actual expenses with the planned ones..

How strictly to do all this, everyone decides for himself. At first I was very strict about everything, in order to understand where and what was going, and then I relaxed, began to round up and lead everything approximately. The result is a floating budget, in which the main thing is the absence of unnecessary spending, the correspondence of expenses to income (needs, opportunities), and not strict compliance and savings for the sake of saving.

- There are items of income and items of expenditure. The number of articles there and there can be absolutely any, the main thing is that it is convenient for you. I started out with a lot of detail, and then simplified everything and combined many articles. If you do not know where to start, then start with any articles, usually after a couple of months of budgeting it becomes more or less clear. Although I still correct sometimes.

- In my opinion, income and expense items need to be written such that you will then analyze, or for which you need to track the dynamics. If this is not important to you, then in general you can make one item of expenditure and one item of income. And in general, the entire budget can be reduced to a paper envelope, that is, put in it at the beginning of the month the amount that you are going to spend, and then there will be something left to watch or not.

- I write down expenses every day, it's more convenient this way, and it only takes a couple of minutes. But basically the application on the phone does everything for me, recognizes sms and writes them to the database. And when you need to plan something serious, for example, wintering in Thailand, then you can sit for half an hour.

- Both husband and wife can manage the budget, both together, and someone alone. As you agree, in general. Or rather, who will like it more. True, when they lead together (both celebrate and plan), it will be easier to discuss something than if someone distances themselves from it.

- Whether it is worth keeping a joint or separate budget, I will not say. There are different opinions on this matter. I personally accept both. When in a couple, both are self-sufficient and earn, then, firstly, everyone is more calm and confident in the future, and secondly, they will only be glad to have a separate budget.

- You can keep a budget without planning at all. That is, it is easy to mark income / expenses and check if everything is in order there (control). Some applications and online planning services do not.

- The essence of spending control is that you have a positive balance (reserve), that is, a positive difference between income and expenses. Let not every month, but in a quarter or a year. Well, so that the tendency is visible, whether you live in the negative or in the plus. This reserve can be accumulated or spent on something useful.

- Usually in all smart books it is advised to save 5-10% of income in the financial buffer or invest, regardless of goals. 5-10% is, in fact, the amount that is practically invisible for any income. I do not have such strictness. Sometimes I climb into the buffer (go into the minus), sometimes I postpone 50%.

Family budget programs

How to choose a program

You can make up any table of the family budget in Excel that is convenient for you, or use ready-made services / applications for maintaining a budget, since they are now in bulk (Drebedengi, Zen-mani, Monefy, etc.).

Some of the services have their own site-service and a mobile application, some have only an application, and some have only a website. In my opinion, the option is more convenient when it is possible to use both the application on the phone and the online version on the website from a laptop. This was one of the reasons why I chose Drebede money at one time and have been sitting on them for many years..

Try Bullshit>

You can also do it in the old fashioned way - write it down on a piece of paper. However, there is a risk that this piece of paper will be lost at one fine moment, and it is much easier to fix something in the electronic budget..

How did I choose a program to manage my family budget? I went to Google Play, downloaded about 5 android applications that I liked from the screenshots and descriptions, and started trying them. About 10 minutes for each application. As a result, there were two that were more or less clear to me, or in other words, where the logic of budget management suited me. It is important that my principle of conducting in my head coincided with the intention of the author of the application. Otherwise, it will take a very long time to delve into, but how to do what. No, everything should be intuitive. Next, I tried to mark expenses for a couple of days in order to understand whether it is convenient for me or not..

How to keep a budget in Excel

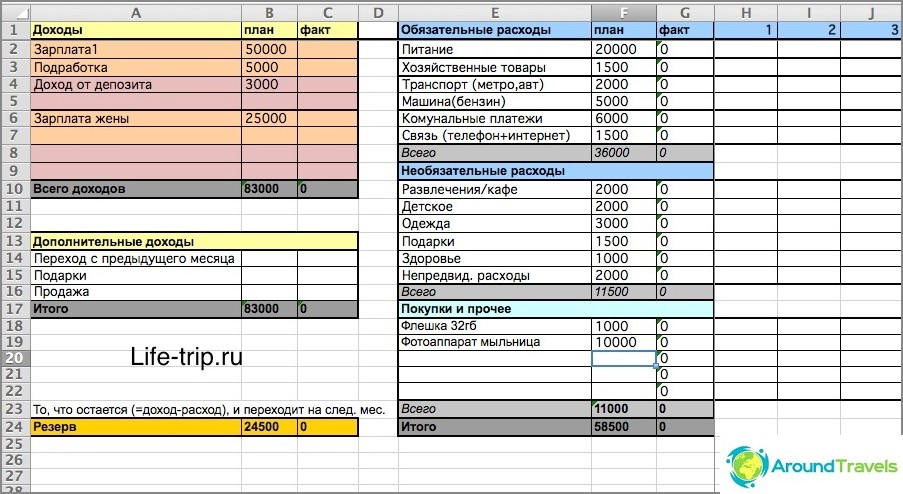

From 2008 to 2013, I kept a budget in Excel. You can download an excel file that represents a simplified template for my budget. Or here's another last revision of my budget (a more complex file), taking into account different income / expense channels (cards, electronic money).

One sheet in Excel is one month. The monthly budget is scheduled for 2-3 months in advance, no less. To plan six months in advance, you need to create 6 more sheets with the name «month year» (to make the formula work), and so on.

Each month there are two columns - planned spending and actual. The first column is for planning, the second for current spending.

How to keep a budget in Excel

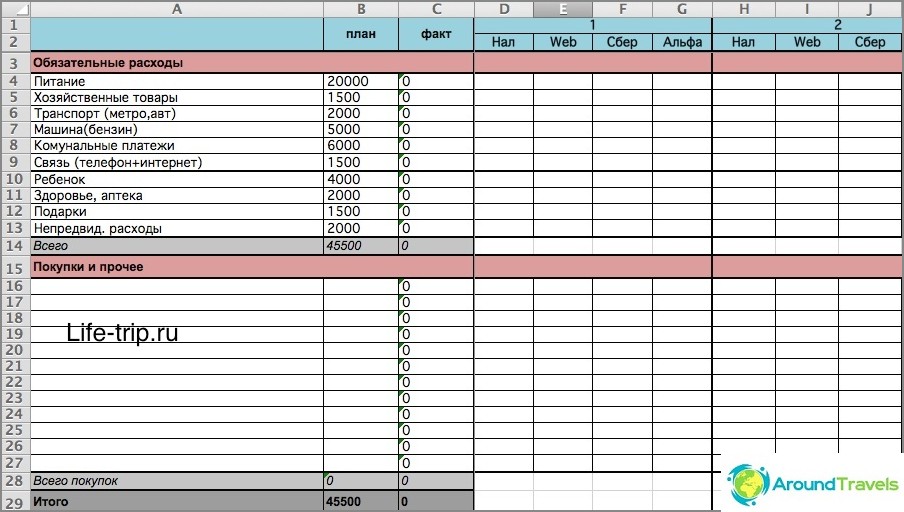

In my file (especially in the second one) there are formulas, if you are not friends with them, then it is better to try to do something of your own or use ready-made services. Otherwise, you will have to figure it out. In short, in the second file, you can mark the costs by days, depending on how you spent them: cash, electronic money, cards. And the balance is then calculated in exactly the same way for all these places of storage of funds.

The second version is more complex

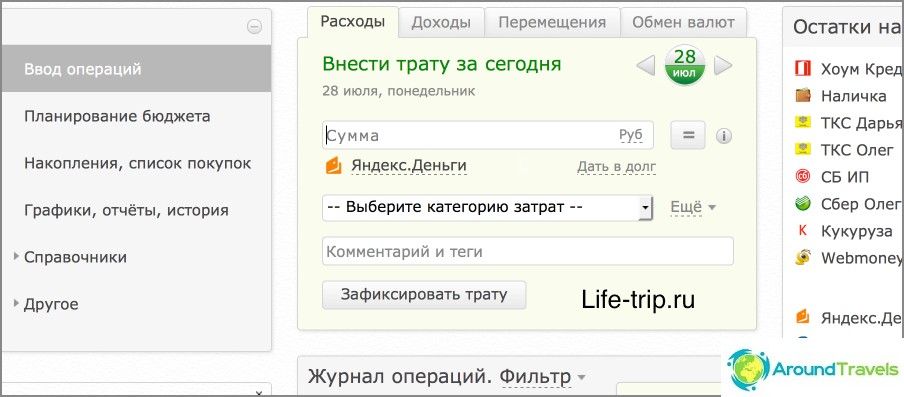

Drebendengi service

Since 2013 I have transferred the budget to the Drebedengi website and am very satisfied. Now I mark all expenses from my phone, and plan on my laptop online.

Many operations are automated, for example, all expenses on a bank card fall into the budget themselves. Thus, if you practically do not use cash (and I just try to minimize it), then there is almost no need to mark anything. Read a separate post on the use of Drebede money and their phone app, because it's too long to tell.

So a simple Excel spreadsheet is good only for a start, to test it so to speak. And after you have decided what the budget should be, you can switch to services, including paid ones.

Budget on the Drebedengi website

P.S. Do you manage your family or personal budget??