Once I used a regular file in Excel, but the world does not stand still, and more than a year ago I switched to Drebedengi. However, if you are not particularly friendly with computers or mobile applications, then try to also start with an Excel file or a regular paper notebook. And to the question why all this is needed at all, read in my post - How to manage a family budget.

To be honest, I resisted the transition to the service for a very long time, because this is a habit. But, when once again, I came across the fact that my file lacks a currency exchange, input of spending in another currency, it is impossible to quickly add a source of income or a category of spending, I realized that it was time to move on to more technological solutions, where all this is done in two clicks.

The content of the article

- one My short review about Drebedengi

- 2 Preparation before use

- 3 How to use Junk Money

- 4 Budgeting in another country

My short review about Drebedengi

Why did I choose them? It's simple - their structure / logic roughly corresponds to what I had in Excel spreadsheets (and in my head). That is, I took several applications installed on my phone, and looked how much time I needed to figure it out and whether it was convenient for me.

The easiest thing for me turned out to be Drebede money. That is, it's not that I directly recommend them, it's just that they fit me. And you will have to choose what is convenient for you. By the way, the site has a demo mode, you can always go in and climb inside without registration.

Try Bullshit>

Also, in addition to simple logic, the plus is that Drebedengi is a service consisting of applications for the phone (Android, iOS) and a browser-based online version. And, by the way, it is the site itself that is the main service, where budget planning, cost categories and storage locations are created. And mobile applications perform only the function of marking expenses. Something in this spirit I needed.

The planning section is paid (500 rubles / year), as well as using the application (50 rubles / year). In my opinion, 550 rubles is a very small amount of money for such a service. And there is no need to be wise over files in Excel every time. People spend more on online games. But, if it is essential for you to use a free service, then you will either have to use Dumb money without planning and without an application, or look for something else, since there are options.

Preparation before use

There are not many preparation steps. If you have already kept a budget before, then you will not have any problems, you will do everything in 10-30 minutes. So, you need to decide on cost categories, sources of income, storage locations. All this is done only on the website, nothing can be created in the mobile application!

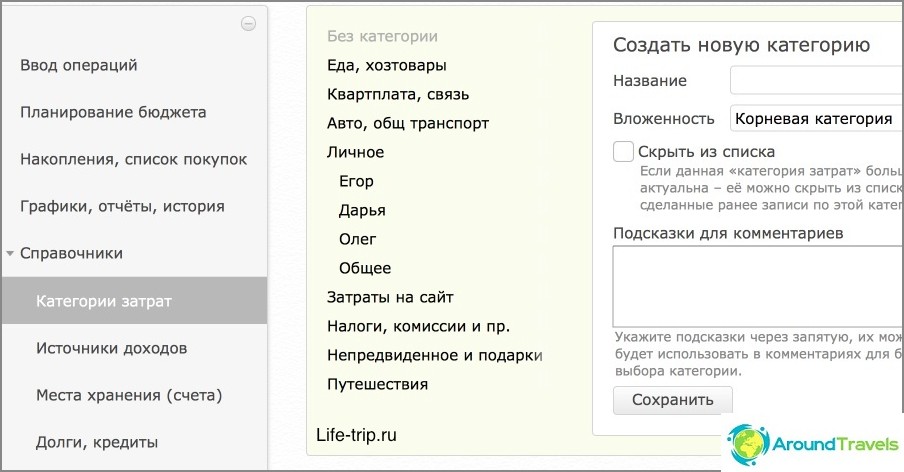

Cost categories

Here you set the names of your expense items: Food, Household goods, Rent, Travel, etc. You can literally make 2-4 articles, or you can do 10-20 in great detail, including those with nested paragraphs. It is also possible to drag the already created categories with the mouse in the order you need and change their names at any time.

List of cost categories

From time to time I change the items of expenditure, although in general the structure has been this way for several years. At first I had everything in great detail, 1.5-2 times more, but then I combined many categories. It makes sense to leave those categories that you will analyze, or for which you need to control spending.

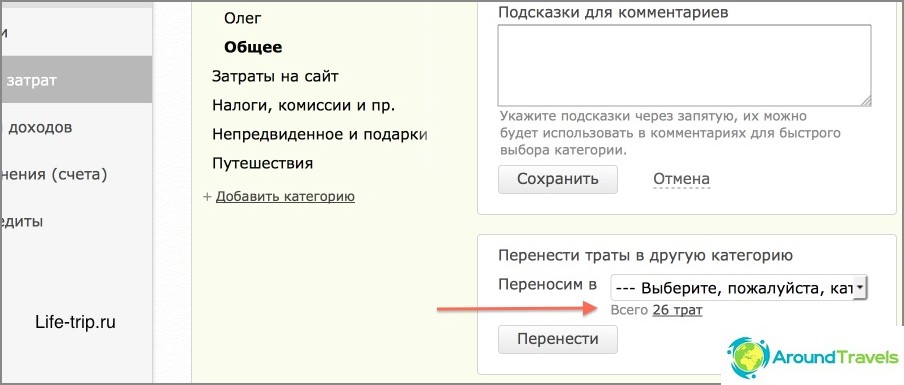

The service has a function of transferring expenses from one category to another. You might need this, for example, if you want to delete a cost category..

It is possible to transfer spending from one category to another

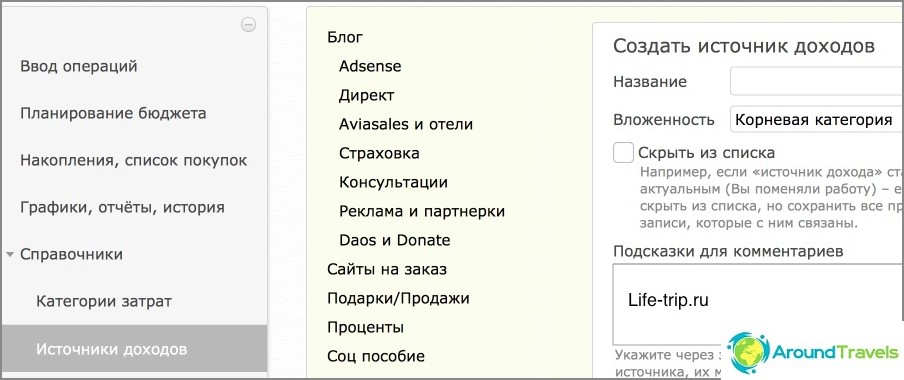

Sources of income

Here everything is about the same as in the previous paragraph, in the sense that the essence is the same. Most likely, you will have literally several sources, of the type «My salary» and «Wife's salary». As a rule, freelancers and all kinds of entrepreneurs have more sources: income from various affiliate programs, from contextual advertising, for services rendered, etc. Again, you can split it in detail, or you can combine it into one category. I will also reduce the number of sources at home, otherwise it has multiplied.

Here you can also write down such items of income as «Deposit interest», «Gifts» etc.

List of sources of income

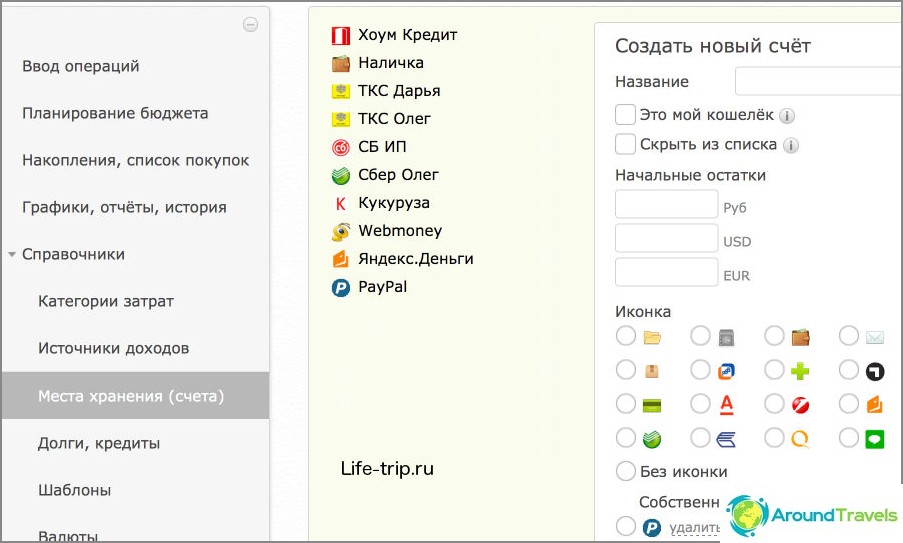

Storage locations

The principle is the same - we indicate all bank accounts and cards, e-wallets, deposits, in general, everything where you have the movement of funds. I used to have two of my bank cards listed here, cash and two e-wallets. Now there are much more points, as well as cards with scores. I can't imagine how I would keep it just in my head.

At the stage of creating storage locations, you will also need to set the amounts that are now on these accounts. This will be the starting point of your finances..

Storage locations

How to use Junk Money

I don't use all the features of the Drebedengi service, but mostly. The main thing I need is spending tracking and planning. Therefore, I will only tell you about this. I will try to briefly and the very essence, otherwise the post will be very long. If anything is not clear, ask in the comments, I will answer.

Expenses / income / transfers / exchanges

Expenses are noted in order to control the expenditure of funds, as well as to have statistics of expenses, which can then be viewed on a separate page or on a graph.

Income is needed for statistics, and in order to understand your reserve, that is, the difference between income and expenses.

Movements are needed in order to move your funds between accounts. For example, you transfer money from one card to another, or put money on an electronic wallet, or withdraw cash from a card. All these operations must be entered in order to correctly display the balance in all storage locations..

Exchanges serve to exchange currencies. You can enter both currency exchange within the same storage location, and between different places.

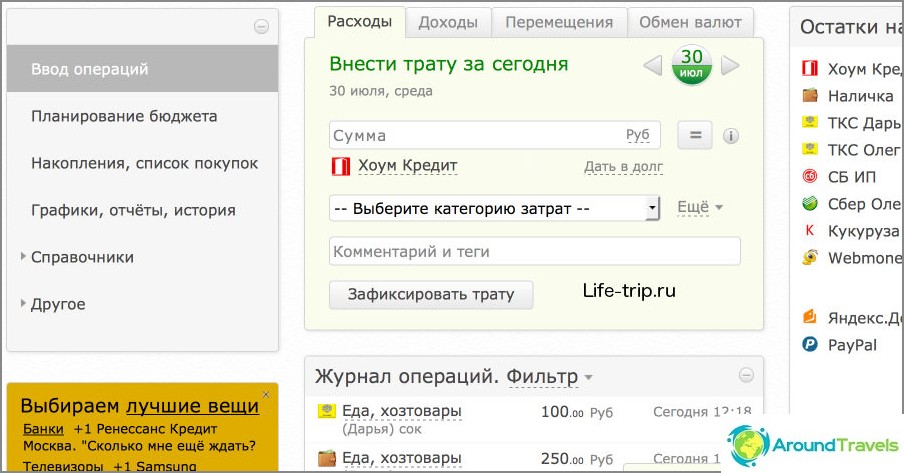

Home page, here we enter expenses, income, movements

All already entered operations are displayed in a list below. You can set a filter to show operations for the current month, for the previous month, for half a year, for a year, etc. I always show the current month.

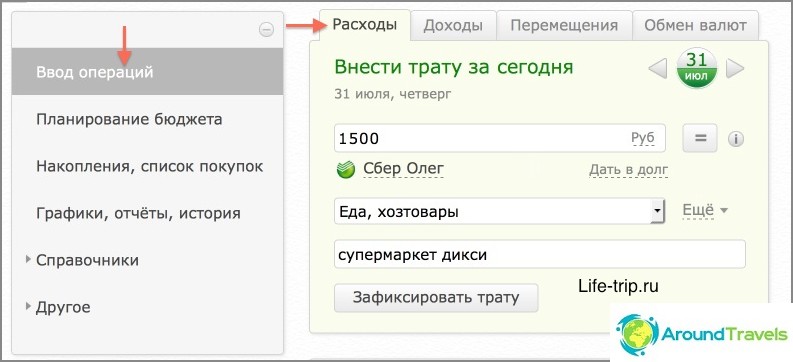

We record operations

After selecting the desired tab, you simply enter the required amount, payment currency, select the cost category or source of income, and the storage location. You can also write a comment («Auchan», «transferred his wife to the card», «bought 100 bucks», etc). A comment can be useful in the future in two cases: you need to remember what kind of operation it was, or you can filter the list by comment in statistics, for example, show all expenses with the word «Auchan» or «supermarket».

Instead of comments that you thought up on the fly, you can specify tags that need to be created in advance, like Cost Categories / Revenue Sources. This is useful for reducing the number of categories. For example, you can create categories «Supermarkets» and «Cafe» and do not use tags, but you can create a category «Food» and two tags «Supermarkets» and «Cafe». In the latter case, you see how much you spend on food in total, as well as how much for each of the tags.

When you enter operations in the application, then it is synchronized in the background (if there is an Internet) and your data becomes visible in the browser version.

On the site

We choose «Entering operations» on the left in the menu (this page opens itself initially) and we see a window in front of us where you can select tabs «Costs», «Income», «Movements», «Exchanges».

We add the operation to the budget

In the mobile app

By selecting the tab «Input» at the top (it opens itself by default), you see other tabs at the bottom: Expenses, Income, Movements, Exchanges. Select the desired one and enter the operation.

There is also a tab at the top. «Balance» and «Reports». The first tells you how much money you have in your accounts at the moment, and the second tells you where you spent your money today, yesterday, the day before yesterday, etc..

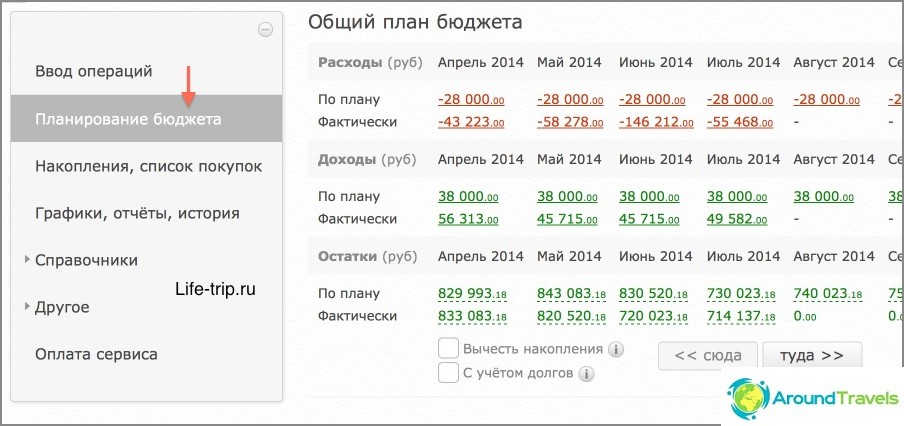

Budget planning

This is an even more important section for me, because with it you can plan future trips, purchases, savings. How convenient is it to know how much money you will have in six months..

The family budget planning section, one might say, is not related to your current expenses and income, that is, nothing is automatically calculated, therefore, you need to enter everything manually. It is not long, it takes 5-10 minutes, but this is if you have been keeping a budget for a long time and know all the amounts from memory.

You need to create a list of estimated expenses and a list of estimated monthly income with amounts. Then set the duration of such a plan, for example, 6 months, and that's all. At any time, the entire plan or a specific month can be edited. When the period ends, the plan can be deleted and a new one can be created. Well, or delete earlier, if required. The only pity is that you cannot create several plans at once with different layouts in order to play with numbers..

Demo budget planning

Income plan

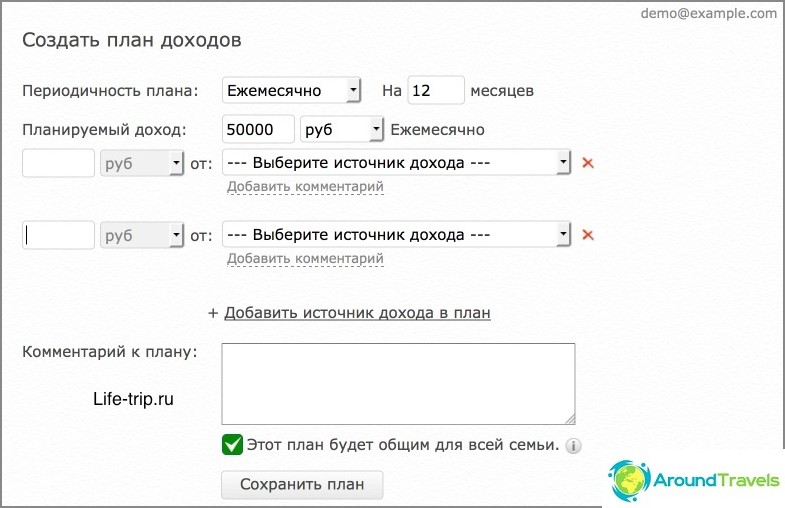

Go to «Budget planning» and click «Create». In the next window, enter the parameters you need: the frequency of the plan (weekly / monthly), the duration of the plan (number of months), and your income. Here you can simply indicate the total income, or by sources, then it will be summed up by itself.

Create an income plan

Expenditure plan

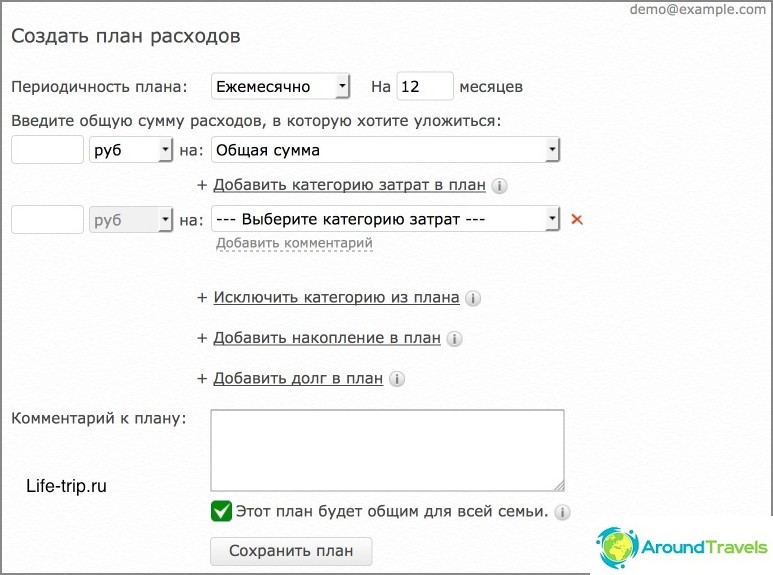

Go to «Budget planning» and click «Create». In the next window, enter the parameters you need: the frequency of the plan (weekly / monthly), the duration of the plan (number of months), and your expenses. Here you can simply indicate the total expense, or you can specify it by cost category, then the expense will be summed up. You can also add savings to the plan and debts here..

Create an expense plan

Budget analysis and statistics

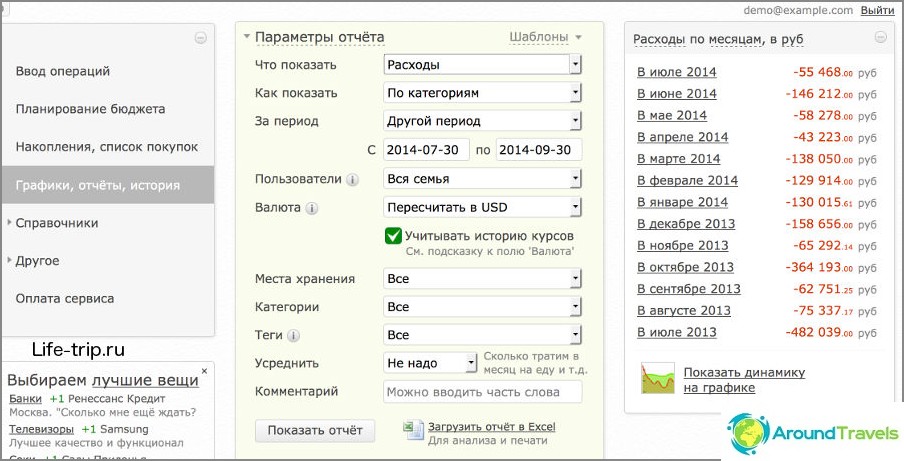

In a separate section «Charts, reports, history» (this item is on the left in the menu) you can analyze all your operations, both income and expenses. In the middle window there is a bunch of filters with which we can get the list of operations we need. Here you can, by category, by storage location, by tags, and by comments (and you can only write the first few letters of the comment).

Budget analysis

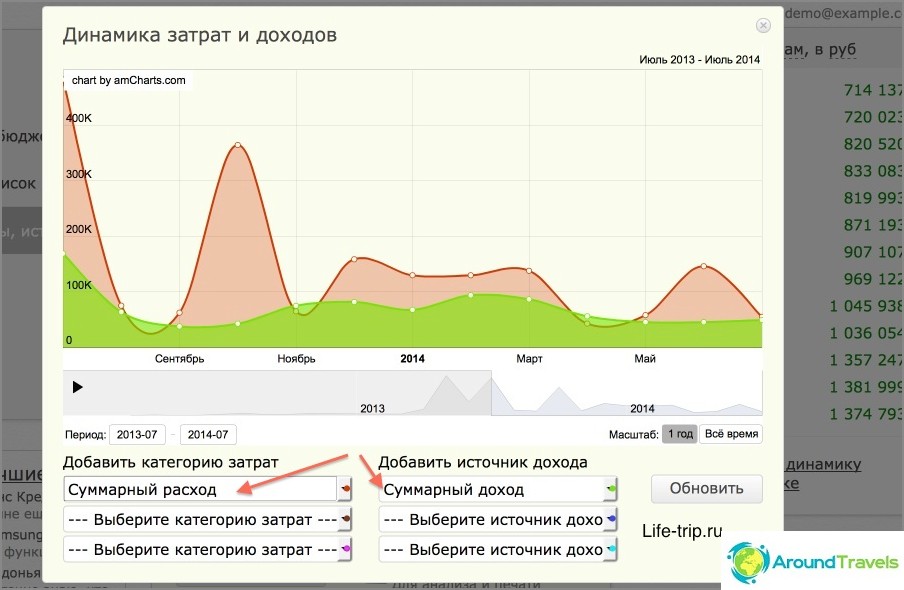

The window on the right displays by default «Costs» on «months». Instead of «Expenses» you can watch «Income», «Leftovers» and «Income + Expenses». Instead of «months» you can choose to display by «days», «weeks» and «years». But it is more interesting to watch it graphically, there is also such a function at the bottom of the window - «Show dynamics on the chart». The graph shows both total income / expenses and by specific categories. Unfortunately, this is where its capabilities end..

Income and expense charts

Budgeting in another country

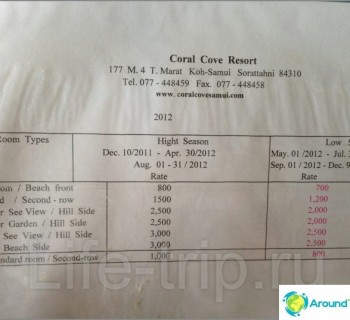

I remember that they once asked me what to do when you are in another country, how to maintain a budget, because we pay in foreign currency, and withdrawn in rubles (as a rule, everyone has ruble cards).

In Thailand, I did it simply - I marked all cash in baht (after all, before that I had withdrawn cash baht from an ATM). When paying with a card, I immediately noted the amount in rubles (and not in baht), which came to me by text message. Well, when withdrawing cash from an ATM, I did «Currency exchange» and at the same time indicated different storage locations.

So it will be easier to create a new currency. «baht» in «References / Currencies». By default, there are initially only rubles, dollars and euros..

P.S. Here's a mini-instruction turned out, like the main thing told everything.