To receive income, you must have primary documentation, that is, you simply cannot receive money, there must be a justification. At first this is very unusual, because when you work as an individual, there is no such paperwork, but in practice everything is not as difficult as it seems. I am not at all afraid to issue an invoice or send an act, given that all the templates are always at hand in the accounting service, from where they can always be downloaded.

The content of the article

- one Primary documentation for individual entrepreneurs

- 2 Conclusion of an individual entrepreneur agreement or acceptance of an offer

- 3 Act of work performed or services rendered

- 4 Invoicing

- five Keeping KUDIR

- 6 Why do we need primary documents

Primary documentation for individual entrepreneurs

My post was written on the basis that I chose the simplified taxation system (STS 6%) and perhaps there are some nuances in other systems. Nevertheless, the contracts / acts / accounts / Kudir will be approximately the same for everyone and the essence of the primary documentation does not change either..

Almost all forms and ready-made templates can be downloaded from the Internet if you need them. Since I have been using the My Business service for a long time, I download everything from there. Moreover, in the same place they are kept in my completed form. The invoices and acts are the same, but there are many different templates for contracts. I also conduct KUDIR in My Business.

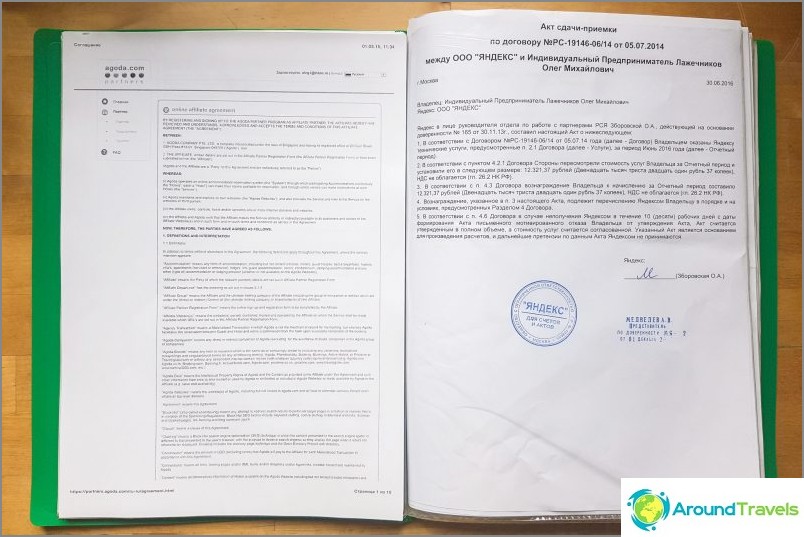

Primary documents for individual entrepreneurs - my folder

Conclusion of an individual entrepreneur agreement or acceptance of an offer

So, before doing any work or providing a service, you need to conclude an agreement, sealed by the signatures of the parties and seals (an individual entrepreneur can only sign a signature, a seal is optional). If you conclude an agreement with a company (affiliate program) that pays you money, then it already has a contract anyway, and you will not have to invent anything. This is, of course, if there is an option of working in a white way with payments to a bank account, and not just to electronic wallets..

Many affiliate programs or services work under an offer agreement, which can be downloaded as a pdf file on your computer. The offer does not require the signing of the parties and during registration (creating a personal account) you agree with it (accept). This is tantamount to subscribing. Date of conclusion of the contract - date of acceptance of the offer.

For private clients, the contract will have to be done independently. There is some snag, because few of the users will want to conclude a one-time contract for some small services, such as consulting or creating a blog. This is the convenience of the Internet, that there is no need to go anywhere, and the customer will definitely not want to leave the house for the post office to send the original of the contract. But there is a way out of the situation - the same public offer agreement (example of a contract). You can post a link to the offer on your website, for example, next to the button «Send request» and sign that when sending such a message, the user accepts the offer. You can decide for yourself which action is more appropriate and after which the offer is considered accepted by the customer (payment of the bill, registration on the website, etc.). Thus, everyone is happy: both the customer (his signature is not needed) and you, who did everything within the law.

Act of work performed or services rendered

After you have completed your job, you submit an act of completed work, or an act of services rendered. You will have to send the original of this act to the customer by mail, and he must sign it and send it back to you (this can also be done in person). Since not every customer wants to sign something there, then usually a line is written in the contract (or offer) that if the customer does not sign the act and does not send it back, then the work / service is considered to be performed properly. And in your hands you have a piece of paper from the post office (you need to send it with a receipt confirmation) that you sent the act, that's enough.

But I have described the ideal option for you. Some affiliate programs (we are talking about freelancing more) do not need your acts, or they themselves send you a report / act by mail every month (or another period). Rather, the acts are needed by the Individual Entrepreneur himself to prove that the work was done and the service was provided, if suddenly the customer wants to return the money back. As primary documentation for the tax office, a bank statement with your transactions will be sufficient..

So far I have not found an option so that the acts can be exhibited electronically. Yes, this can be done, and in the offer contract it is prescribed that the act is sent by e-mail, and then the customer must sign it and send it by regular mail, and if he does not do this, then the work / service is considered to be performed properly. But I was not advised to do this, because I have no documentary evidence of the act being sent in my hands. Or, as an option, do not issue an act at all and be content with an extract from the bank, where there is a fact of payment for work / service.

Invoicing

Another primary document is the invoice. You exhibit it after completing the work / service along with the act. But the invoice is not required, in fact, these are just your details, according to which the customer must pay for your work, and the required amount of payment. The invoice is often issued by email, on a letterhead or in a more or less free form. However, some companies may still require you to send the original invoice later..

Keeping KUDIR

KUDIR is a book of income and expenses, where you enter all receipts and all expenses in chronological order and on the basis of primary documents that support your income (bank statements, contracts, acts). In the case of the STS 6%, it is not necessary to mark the expenses, they do not participate in any way calculation of tax, but I do it anyway for my convenience. If you have a simplified taxation system of 15%, then expenses must be noted, otherwise you will not be able to calculate the tax.

Previously, KUDIR had to be certified by the tax authorities, but we are lucky and since 2013 this is not required. KUDIR can be conducted on paper or in electronic form, as you wish, but I am in favor of modern methods. At the end of the tax period (for the USN, a calendar year), the book is printed and stitched, and a new book is opened in a new period. You can download the KUDIR blank here.

Stitching is actually optional, as well as printing. Now, if there is a tax audit, then it will be possible to do this, and so why once again transfer the paper.

Why do we need primary documents

An important question: are these documents still needed? Answer: according to the law, yes, but in reality it will only be required for desk audits (the tax authorities call individually). That is, in ordinary life, you simply keep them, lead the KUDIR, and do not hand over anything anywhere. As far as I understand from the forums, such checks are very rare when it comes to small individual entrepreneurs with simplified taxation system.

It's better to think about how to minimize your documentation if your activity is simple. For example, to reduce the number of transactions - let some affiliate program transfer money not once a month, but a couple of times a year. You can use affiliate aggregators, and not each separately. For private clients, you can connect payment on the site from a payment aggregator, like Robokassa, then all payments you will have will come from the service (and not from clients), and the documents, accordingly, will be from it..

P.S. If you have not yet registered an individual entrepreneur, then be sure to read my step-by-step instructions, I described all the actions in great detail there7