I thought about this for a long time, and finally decided. I have been studying the forums for several weeks. Although almost everyone I asked did not advise registering an individual entrepreneur, they say, I worry in vain. But I decided on my own experience to check whether it is so scary, difficult, etc. It's never too late to close, and it's done quickly now. So I'll see how and what, and then you look and emigrate somewhere, and you can replay everything, but for now the experience will not be superfluous.

The content of the article

- one What you need to know before registering

- 2 Registration of an individual entrepreneur step by step instructions in 2019

- 2.1 Selection of OKVED codes

- 2.2 Choice of taxation system

- 2.3 Submission of documents to the tax office via the Internet

- 2.4 Get documents from the tax office

- 2.5 Obtain a registration number from the Pension Fund of the Russian Federation (if it was not issued by the tax office)

- 2.6 Get codes from Rosstat (optional)

- 2.7 Send notification to supervisory authority

- 2.8 Open a bank account

- 2.9 Order print

- 2.10 Enter into contracts with companies that pay you money

- 3 After registration in the process of work

- 3.1 Pay contributions to the Pension Fund by December 31

- 3.2 On the simplified tax system, pay an advance tax on a quarterly basis by the 25th of the month following the quarter

- 3.3 Pay tax at the end of the year by April 30 of the next year

- 3.4 Submit a tax return to the simplified tax system before April 30 of the next year

What you need to know before registering

Before starting to do something, I read quite a lot of different topics on the forums, and also consulted with accountants from the My Business service. I boldly add one more minus to Pros and cons of freelancing, because the office worker does not need to go through all this.

Primary documents, sources of income

You should not rush, it is better to take into account all the nuances in advance. For example, you need to understand which primary documents will be in your hands when you receive this or that income. That is, you need to find out how to get official income from each of your sources (Webmoney, affiliate programs, contextual advertising) and how to minimize losses. You can read my thoughts on this topic here - How to legally withdraw Adsense and Webmoney.

Also, one of the factors that influenced the decision to register an individual entrepreneur was comparison of different withdrawal methods, where it turned out that it is most profitable to do it through individual entrepreneurs, and even with the payment of tax.

Account in My Case for help

I recommend using My Business at the very beginning, even if you are not going to use this service later. The fact is that the preparation process will be greatly simplified, since there is a free wizard for preparing documents for registering an individual entrepreneur in steps. Straight inside and out, with all the tips on what to do next, there are answers to all questions. A very handy thing! If you decide to pay for the service, then accounting consultations will become available for paid accounts, which you can use even before registering an individual entrepreneur (and after of course).

My Business will be useful in the future. A special calendar will indicate the dates of payment of taxes and contributions, and there will be a calculator for calculating with the subsequent sending of the payment to the bank, that is, you will not miss anything. The latest changes in legislation and documents will be taken into account, there are forms of contracts, accounts and acts that will be useful in work. I constantly issue acts and invoices to my counterparties and they are then stored in my personal account. There is integration with a dozen banks: Tinkoff, Modulbank, Tochka Bank, Alfabank, Promsvyazbank, Raiffeisen, etc.), which is very convenient for conducting KUDIR, and integration with Sape and Robokassa. And in the end, with the help of this service, you can submit tax reports via the Internet. Actually, this is exactly what I really need, because I am not always in Moscow, yes, and in any case I would not want to go to the Federal Tax Service with my feet. Also, at any time, you can ask a question to accountants on tax and accounting issues, and they often appear. It all costs money.

At first I paid for a year, and thanks to this, the whole process was greatly simplified for me. At first, it is very convenient, and then if everything seems very easy to you, then in a year you can do it all yourself, no problem. Although the amount is very small, and it will save a lot of time, even if I have only 10 payments per month: I don’t think about any changes in KVK codes in receipts, about changes in tax rates, all transactions with the bank are automatically synchronized, templates of acts are always at hand / accounts, etc. In short, I tried My Business and now I don’t want to do it all myself, I’m ready to pay. Read my review about this service.

A year later, I renewed it for another two. There were thoughts of moving to Kontur-Elba (try it), but they gave a good discount right one month before the end of the paid time, and when paying for two years at once, it turned out very cheaply (2 years turned out as 1).

What are the costs of individual entrepreneurs

First of all, you will need to pay tax (6% or 15% on the simplified tax system), and you will also have mandatory contributions to the Pension Fund. Everything in detail in this post wrote. There all this is sorted out in detail, I will not dwell. But there may also be not obvious costs: losses in withdrawing money, losses in receiving money, expenses for accounting services, etc. It is difficult to speak in general here, everyone will have their own specific situation. So far, I have decided to conduct my business in such a way that additional losses are minimal. Partly I wrote about this in the article Comparison of Webmoney withdrawal to Epayments and IP account.

It is also worthwhile to understand that there will also be losses of time: you will have to deal with the mandatory primary documentation (contracts, invoices, acts), taxes and contributions to the FIU, and other aspects.

How much does it cost to register an individual entrepreneur

- State fee - 800 rubles

- Printing - 500 rubles (optional, since the individual entrepreneur can work without printing)

- Opening a current account - 1000 rubles (it is not necessary to open an account)

- Certification of signatures and copies of documents when opening an account 300-800 rubles (if you do not open an account, then this waste will not be, and many banks do it for free)

- Intermediary services - 1000-3000 rubles (using the services is optional)

In total, it turns out that the obligatory spending is 800 rubles. And if with the opening of a current account and certification of the signature, then it will turn out ~ 2300 rubles.

Although, if you find a bank with free opening / certification, then all these costs will not be.

I do not recommend using the services of intermediaries, because this makes little sense, there are many more questions not about registration (it is not difficult there), but about the conduct of activities. Moreover, mediation does not exclude the need to go to the tax office in person (if the power of attorney was not made, of course). Therefore, if you really want to use the services of third-party people, then even if consultations are carried out, this is more valuable. Only all this (and not only) can be obtained in My Business for less money.

Registration of an individual entrepreneur step by step instructions in 2019

Since 2016, a new administrative regulation has appeared on the procedure for registering a business (and individual entrepreneurs), now you can submit documents for registration through the MFC. At the same time, the need to notarize the signatures of persons who can confirm their identity when submitting documents has disappeared. Since 2017, the limits on the simplified taxation system on income have increased to 150 million rubles.

- Selection of OKVED codes

- Choice of taxation system

- Submission of documents to the tax office via the Internet

- Get documents from the tax office

- Obtain a registration number with the FIU

- Get codes from Rosstat (optional)

- Send notification to supervisory authority

- Open a bank account

- Send registered letters to the tax office and the Pension Fund of Russia about opening an account (from 02.05.2014 it is not necessary)

- Order printing (optional)

- Enter into contracts with companies that pay you money

- Submit information on the average number of employees by January 20 (if there are employees)

- Pay contributions to the Pension Fund by December 31

- On the simplified tax system, pay an advance tax on a quarterly basis by the 25th day of the month following the quarter

- Pay tax at the end of the year by April 30 of the next year

- Submit a tax return to the simplified tax system before April 30 of the next year

Selection of OKVED codes

You need to select in advance the OKVED codes for the activity that you are going to conduct. Without these codes, you cannot fill out an application for registration of an individual entrepreneur. More about OKVED codes read in my article.

Choice of taxation system

In addition to the OKVED codes, you still need to decide on the taxation system. Most use the simplified taxation system of 6% or 15% (simplified), which means payment of 6% of income, or 15% of the difference between income minus expenses. I naturally chose 6%, because I have almost no expenses, like most of those who make money on the Internet or remotely. There are other taxation systems (OSNO, UTII, PSN), but I will not write about them here, read here.

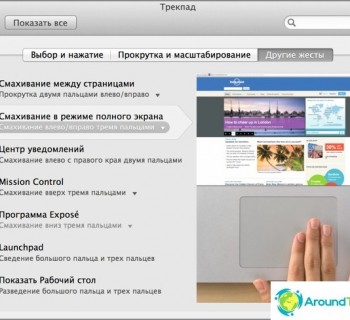

Submission of documents to the tax office via the Internet

You can submit documents to the tax office via the Internet, which I took advantage of. You can apply both through the tax site here, and through government services. It seems that it does not depend on the region, at least government services give a choice of any city. I chose the first way.

A description of the registration process, as well as answers to basic questions, are available on the tax website in a special section..

Documents required for registration of an individual entrepreneur:

- The passport

- INN

First, you need to fill out a questionnaire on the site, you do not need to enter any specific data here, except for the TIN. If you don't know him, you can immediately recognize him. But if it has not been received yet, then I do not know if it is allowed to submit an application without it, I did not check it. The TIN can also be obtained via the Internet, but you will probably have to go for it first. And if you submit in person, and not via the Internet, then an application for a TIN is also attached, only the period increases from 5 days to 10. By the way, as far as I understand, now there is no need to file documents for personal filing.

Next, in the next step, you will need to enter in advance selected OKVED codes. Just keep in mind, you need to do this quickly, the session time expires quickly.

Application number F4130909226611 has been sent for consideration to the tax authority.

No later than three working days, a message about the results of the consideration of the application will be sent to the e-mail address specified in the application.

Then you pay the state fee through the Internet bank (for example, Sberbank-Online) or according to the receipt at the bank. Now you just wait for an invitation to the tax office in 3 working days (I waited 4 days along with the day of submission of the application), this is faster than submitting in person (in this case, they wait 5 days). Please note that if you paid the state duty via the Internet, you will need to print an extract from the Internet bank, because the confirmation of payment will need to be brought to the tax office anyway..

Get documents from the tax office

The email received:

In the period from 13.09 to 17.09, a person registered as an individual entrepreneur can contact the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46, address: 125373, Moscow, Pokhodny proezd, household 3, building 2. Reception on the issues of state registration of individuals as individual entrepreneurs is carried out: from Monday to Thursday from 9-00 to 18-00, on Friday from 9-00 to 16-45.

When applying to the tax authority, you must submit:

- original and copy of identity document,

- original and copy of the document confirming the place of residence (if this information is not contained in the passport),

- document confirming the payment of the state fee.

If, after registration as an individual entrepreneur, it is planned to apply a simplified taxation system, it is also necessary to submit an application for the transition to a simplified taxation system..

After the specified period, the application F4130909226611 is canceled.

After receiving an invitation by e-mail, come at the appointed time at the 46th tax office (for Moscow). A fork is given in 3 days, if you do not come, then the application will be canceled. And, if you have chosen the USN, then in addition to your passport and its copy, you still need to have an application for switching to the USN in two copies (form). In the tax office you will receive in your hands:

- Certificate of state registration of an individual as an individual entrepreneur (OGRNIP)

- Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

- EGRIP record sheet (I have two documents: 1st on making an entry on accounting in the tax, 2nd on the acquisition by an individual of the status of an individual entrepreneur)

- Notification of registration of an individual with a tax authority

- Notification of registration of an individual with the territorial body of the PFR

- Notification of the assignment of statistics codes (from Rosstat)

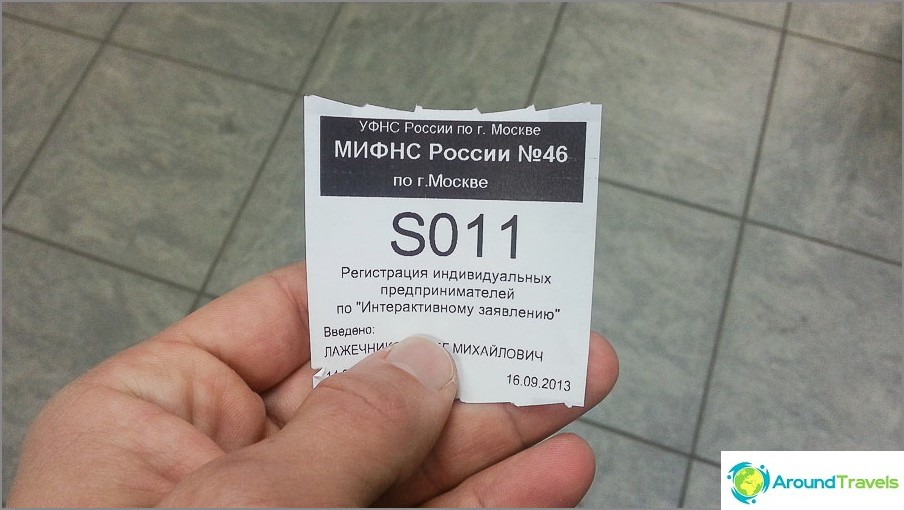

The last two documents may not be given (I was not given). Everything went quickly, the queue was electronic, I waited at first for 5 minutes, then I signed the papers, and waited another half hour for the documents to be done, for the second time without a queue. And so there are a lot of people in the 46th tax office, but, most likely, they are on other issues. And there were almost no people like me who were submitting documents via the Internet..

Registration of individual entrepreneurs at 46 tax

Registration of an individual entrepreneur via the Internet - a separate coupon

The Federal Tax Service congratulates you on your registration as an individual entrepreneur on the basis of the electronic application F4130909226611 and thanks you for using the electronic service of the Federal Tax Service of Russia.

The appendix contains a certificate of state registration, an extract from the Unified State Register of Individual Entrepreneurs and a notice of registration with the tax authority as an individual entrepreneur, generated in electronic form and signed by the electronic signature of an official of the tax authority.

Obtain a registration number from the Pension Fund of the Russian Federation (if it was not issued by the tax office)

If you were not given a tax notice of registration with the Pension Fund of the Russian Federation, then there are several options. You do not really need the letter from the FIU itself, you need a registration number and details for paying contributions from it. Therefore, you need to either wait until the letter arrives by mail (about 2-4 weeks), or call your PFR department by phone, or go to the territorial department of the PFR yourself. You can also get a reg number through My Business by means of an extract from EGRIP, if you have a paid account there, but you must first wait at least a couple of weeks, because this information does not appear in the register right away. You will need this number in order to pay contributions.

Registration in the Pension Fund is mandatory! Even if you do not operate, you will have to pay fees anyway. And if you have employees, you will also need to register as an employer..

Get codes from Rosstat (optional)

In the same way, if the tax office did not give it, then you need to get it yourself, but this is for the case when the individual entrepreneur fell under the sample and he needs to submit reports to Rosstat (that is, if necessary, then not immediately after the registration of the individual entrepreneur). The letter with statistics codes is optional. Codes are easy to get - everything can be done via the Internet. Here on this page there are various links to various government sites where you can find out. Perhaps someone will have to go personally, for example, the one (and immediately after registration) who will need the original letter from Rosstat. For example, some banks require it for opening a current account.

I tried to get codes for Moscow the next day after registration, but it issued «Nothing found», apparently was not yet in the database. But I don’t need codes, my bank didn’t require it. 4 days after registration, the codes from the link were received 🙂

Send notification to supervisory authority

For some types of activities, it will be necessary to send a notification to the supervisory authorities (by registered letter with an inventory and delivery receipt): Roszdravnadzor (social services), Rospotrebnadzor (trade, consumer services, catering), Rostransnadzor (transportation services, road freight transport activities). But all this activity has nothing to do with freelancing. More details are in this resolution, there is a list. You need to notify one day before the start of such an activity. My File provides a completed notification, and they also send it if an EDS is made.

Notification form

Open a bank account

If you have not yet decided on the bank, then I recommend Tinkoff, I have been in it for quite some time and I like everything. The tariff is only 490 rubles. Also read on this link my post with an up-to-date comparison of tariffs of all banks. Then choose what suits you best..

If you plan to work only with cash, then you have every right not to open a current account. Otherwise, go to the websites of banks in your city, look there for Settlement and Cash Services in the section for legal entities or corporate clients, and see the tariffs. A list of all banks in Russia in general and reviews on them are on the banki.ru website. Remember, the bank must have an Internet bank, otherwise, how else to manage your account.

Account at Tinkoff + 2 months as a gift>

Normal prices are as follows: opening an account 1000 rubles, maintaining an account 0-1000 rubles, transferring via the Internet bank to a personal account of an individual in the same bank 0 rubles, transferring via an Internet bank to a personal account of an individual in another bank 20-50 rubles for payment. Of those banks in Moscow, whose tariffs I looked at, the costs plus minus are the same as I said: Tinkoff, Modulbank, Tochka, in order of increasing service costs. In some banks, such as Tinkoff and Modul, you don't even need to go to the office, an employee will come to your office or home.

Many banks also provide integration with My Business, which is quite convenient - all operations will be automatically loaded into your My Business account. For me, so it is necessary to delegate everything that is possible to the maximum, so that you have time to do your business directly. In Internet accounting services, taxes, fees are also considered, there are consultations, etc. The cheapest option for your accountant.

Quotes My Business>

Elbe Rates>

An important point. As a rule, you bring the OGRNIP to the bank, an extract from the USRIP, a notice of registration with the tax office, Rosstat codes, a passport and a card with your signature (!) Certified by a notary. But many banks can certify such a card themselves for an additional fee (or even free of charge) and on the spot, it is more convenient. In any case, it is better to call the selected bank and find out the procedure for opening an account for an individual entrepreneur. Read more in my article Opening a current account for individual entrepreneurs.

There is no need to notify the tax and pension fund about opening / closing a current account since 2014, thus the procedure for registering individual entrepreneurship has been slightly simplified.

Order print

For individual entrepreneurs, printing is completely optional, you can simply use the signature on documents without printing. The standard cost of printing is about 500 rubles.

Enter into contracts with companies that pay you money

Since you are now an individual entrepreneur, you simply cannot get money. With everyone, both with legal entities and with individuals, you need to conclude contracts, and after the completion of work or the provision of a service, send the customer an act of work performed or services rendered (read about source documents). Therefore, you will need to contact each of the affiliate programs and conclude an agreement with them, after which you will receive money not to Webmoney or the personal account of an individual, but to the current account of an individual entrepreneur. It may not be possible to do this with everyone, and part of the money will still come to Webmoney, so you will need to conclude an agreement with the Guarantee Agency, which will allow you to withdraw money as an individual entrepreneur and to a current account.

After registration in the process of work

After you have registered an individual entrepreneur, you will need to do something else in the course of your activities. If your business is small, there are no employees, you have a simplified taxation system of 6% and you do not work with cash, then the list of actions is quite small.

Pay contributions to the Pension Fund by December 31

Since 2014, the fixed contributions are no longer fully fixed. They are calculated according to the formula based on one minimum wage. For those who have an income of less than 300 thousand rubles a year, they will be just fixed. For those whose income is more than 300 thousand rubles per year, the same formula, but + 1% of income. In 2017, the amount of fixed contributions is 27,990 rubles + 1% of income over 300 thousand rubles / year. More about fixed contributions of individual entrepreneurs.

It is imperative to pay them, regardless of whether the activity is in progress or not. You can pay in any installments or the entire amount at once, but until December 31, otherwise a fine. Naturally, you need to pay proportionally, depending on the date of registration of the individual entrepreneur.

On the simplified tax system, pay an advance tax on a quarterly basis by the 25th day of the month following the quarter

Tax on the simplified tax system is paid in advance payments for each quarter by the 25th day of the month following the quarter. With the simplified tax system (6%), 6% of the amount of all income received to the current account and to the cashier is taken. An individual entrepreneur on the simplified tax system (6%) has the right to reduce the tax due to already paid fixed contributions by 100%. In fact, this means that with an income of ~ 600 thousand per year or more, we will pay only our 6% of the income and that's it. More about calculation of advance payments on the simplified tax system.

With the simplified tax system (15%), 15% of the difference in all income and expenses is taken to calculate the tax.

Pay tax at the end of the year by April 30 of the next year

Tax under the simplified tax system is calculated on an accrual basis - for 1 quarter, half a year, 9 months and a year. The first three payments are advance payments, the last payment is an annual tax (there is no concept of an advance payment for a year or quarter 4). That is, the calculation formula for the STS 6% per year is as follows:

(Total income for the whole year X 6%) - Advance payments for 1, 2 and 3 quarters - Fixed contributions to the Pension Fund = Tax on the simplified tax system for the year.

More about calculation of tax on the simplified tax system for the year.

Submit a tax return to the simplified tax system before April 30 of the next year

The declaration is submitted once a year before April 30 of the year following the tax period. The tax period for the USN is a calendar year, the reporting period is a quarter. Through the service My Business, the declaration can be submitted without leaving home.

P.S. Naturally, I did not take into account all the points related to the registration of an individual entrepreneur and the conduct of entrepreneurial activity. But, as for the STS 6% and the issues related to working on the Internet, there is enough information.

P.P.S. Likes are very welcome, this series of materials was prepared for about two weeks, excluding the time for reading the forums.