The insurance that will be discussed in this article, the insurance companies call the travel insurance policy, travel insurance or travel medical insurance, whoever it is more convenient to call it.

In order to get out of an unpleasant case whole, cured and not much spent, it is worth understanding this system. Because the insurance company - like any similar office - really wants to sell you a policy, but then it really doesn't want to pay. Therefore, in order to deal with this system, it is better to understand how it works; really read the policy - not just sign it. And it's better to understand in advance what to do if something happens. In order not to make mistakes that would allow the insurance to deny you treatment or later to pay for this treatment.

The content of the article

- one How to choose an insurance company

- 2 How is the beginning of insurance validity considered?

- 3 What to do if the insured event occurred on the last day of insurance

- 4 How to renew insurance

- five How to return the insurance policy if the trip did not take place

- 6 How to buy insurance online

- 7 What insurance to do if you are going to ride a bike

- eight Medical insurance for the elderly

- nine Does the insurance cover chronic diseases?

- 10 For a long trip, how best to insure, at home or locally in the host country?

- eleven Why take out insurance in Schengen

- 12 Where to buy insurance for a Schengen visa

- 13 The cheapest insurance for a Schengen visa

- fourteen Why do insurance in Asia

- fifteen Where to buy ISOS assistance insurance?

- sixteen How to find out in advance the hospital where you will be sent

- 17 Do insurance markers look at border crossing

- 18 Is it possible to buy several policies in a row

How to choose an insurance company

First of all, I would like to recommend a mega useful service for comparing insurance prices - Cherehapa. Long awaited! For several years now, buying insurance has become much easier. Now you don't need to check a bunch of websites of insurance companies, you go to Cherekhapa and immediately see the prices for 16 insurance policies and buy there.

For most of the majority of negative reviews on the Internet, insurance representatives answer with reasoned why the insurance did not work. But behind each such case there are living situations - when a person was afraid for the health of his own or a loved one, got confused and made some kind of legal mistake - and as a result did not receive the help that he counted on when he paid for the policy. To prevent this from happening, you must not only insure yourself, but also carefully read the documents that you will be given. And understand in advance the algorithm of actions, what you can count on and what not.

The insurance company that sells you the policy works with one of the assistance (service) companies. I wrote about several basic assists in my article. Travel insurance, and also gave a list of insurance companies with their assistance. Also, other nuances are described there, including good insurance-assistance links, be sure to read!

When an insured event occurs, the victim does not call his insurance company, but this assistant company. How polite and qualified the communication with the operator will be depends on the assistance company, and not on the insurance company. Which hospital will be sent to, will they take care of transport or will have to call a taxi, will they have to pay the bill at the clinic themselves (and receive money from the insurance company after returning home), will they take a passport as a deposit and how many calls will it take to collect this passport - depends on the work of the assistance company.

But you need to understand that the decision to pay bills is made not by the assistance company, but by the insurance company. How quickly an appointment with a doctor will be arranged for you, a car will be called - or you will have to take a taxi, whether they will give the go-ahead to pay for treatment or not - this is already a decision of the insurance company. Unfortunately, there are no insurance without negative reviews, you will have to accept this as a fact, and choose the lesser of several evils..

How is the beginning of insurance validity considered?

It is necessary to carefully read the terms and conditions of a particular insurance company - because different insurance companies have different rules. Moreover, it is the policy that you are signing to read, because often the policy agreement differs from the one published on the website.

Usually, when you apply for an insured event, you are asked the date of entry into the country and may be asked to scan and send all the pages of your passport to make sure that you have not spent all your days abroad on this policy..

If you have two policies, one of which has 10 days left, and the other 5, then they are not added, but spent at the same time - because each company will check your days abroad.

What to do if the insured event occurred on the last day of insurance

If the insured event occurred on the last day, the main thing is to have time to register it (call the assistance) before the expiration of the policy. The conditions for all insurance are different, but usually the insurance provides that the treatment takes some time and can continue even after the end of the policy. But exactly how many days are given for treatment after the end of the policy depends on the conditions of a particular insurance.

What definitely does not make sense to do is to buy a few more days of the same insurance, because the insured event will not apply to them. This is a new policy, it cannot be related to something that happened before it was purchased..

Moreover, if the insurance company agrees to issue a policy remotely, such a policy begins to operate in a few days..

How to renew insurance

You cannot renew your insurance policy. You can buy a new one. But it should be borne in mind that not all insurance companies sell policies over the Internet, and not all insurance companies will consider it valid without crossing the border. That is, it is assumed that you buy a policy while in Russia, and then cross the border.

Also, some insurance companies have a temporary delay. For example, when buying a policy from Liberty while abroad, you need to wait 5 days after purchasing the policy before it becomes effective (that is, you can indicate the start date of the policy not with today's number, but counting 5 days in advance). This is how they protect themselves from scammers trying to buy a policy on the day of medical problems..

Details of those insurances that can be bought while already abroad, I wrote in this post.

How to return the insurance policy if the trip did not take place

Different insurance policies may differ, but usually you can drop it in and get your policy back, minus the cost of overheads, before the policy starts. Usually this is about a third of the cost of the policy..

After the start of the policy, it is usually impossible to return it, even if you have used 2 days out of six months.

How to buy insurance online

When drawing up an insurance policy via the Internet, instead of printing, an electronic signature is used, which is no worse than printing on a paper policy. («the federal law «About electronic signature» No. 63-ФЗ dated 06.11.2011.») You can also play it safe, after buying the policy, call the company and check it by number. I have already bought policies Absolute, Consent, Liberty several times through the Cherehapa service, and every time I did it online, paying by credit card. No problems, the policy came to me by email in electronic form, and then I used it in the desired country.

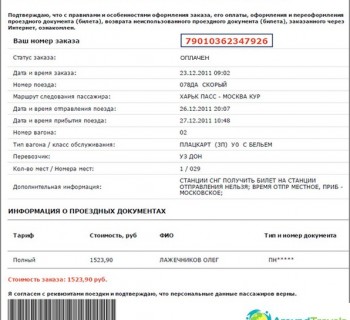

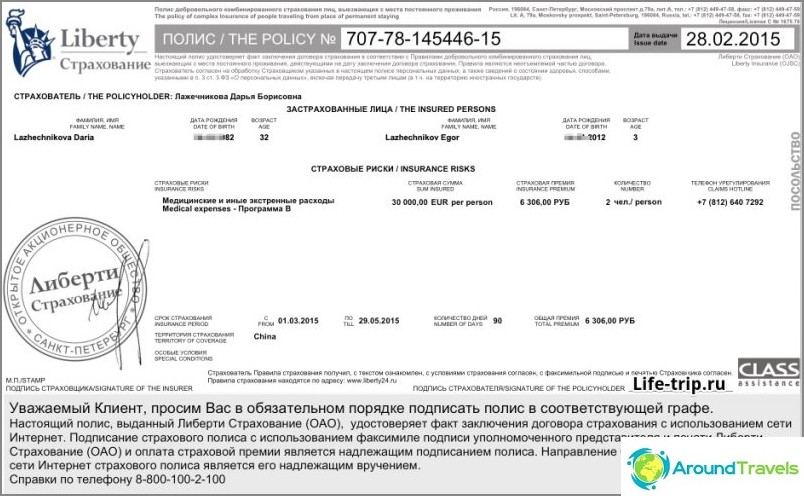

This is how travel insurance looks like (plus several more pages of the contract)

The main thing is that if you are not already in Russia, be sure to check before buying when it will begin to operate, and whether it is generally forbidden by the rules of the insurance company to buy a policy while abroad. Because, for example, according to the rules of the same Liberty, the policy in this case will take effect in 5 days. And many companies do not sell a policy at all for a person who is no longer in Russia. Details of insurances that can be bought while abroad in this post.

In case of an insured event, many companies ask to send a copy of all pages of the passport. If it turns out that at the time of insurance the person was not in Russia, this may serve as a reason for the insurance company to recognize the policy as invalid (and, accordingly, refuse to pay for the treatment).

What insurance to do if you are going to ride a bike

It is necessary to carefully read the terms of your insurance, what is written in the insurance contract. According to the rules of most insurance companies, riding a bike (motorcycle) is covered only by the package «Sport» or «Leisure» (and is not covered by the usual). You need to read the rules of each insurance company. Or go to the same Cherekhapa and put a tick in front of «Traveling by motorcycle / moped», which is in the section «Sports and outdoor activities». Then you will immediately see the price change and the filtered results by insurance.

Some insurance companies have bike management as standard. One example Tripinsurance.

When an insured event occurs, always be prepared for the following questions:

- who was driving

- if the victim was driving, does he have a category A license

- whether the victim consumed alcohol (and in the hospital they can check for alcohol, not believing in the word).

The last question for solving the insurance key - if you drank, then no case will be recognized as insurance.

The rights of category A also play an important role - it is quite normal and common for a situation when, despite the purchased sports insurance, the insurance company ultimately refuses to recognize the case as insurance, citing the driver's lack of rights of the required category. Therefore, those who drive without a license often pretend to be passengers or do not say at all that they fell off the bike. Accordingly, if you do not have a license, then there is no point in making insurance with an additional package, just overpay in vain. Still, I would recommend driving with a license or trying not to mention the bike..

Medical insurance for the elderly

Not all insurance companies provide insurance for travelers over 65, and almost all of them introduce coefficients for payment (that is, the cost increases several times). Rosno insures up to 85 years old, the coefficient begins to be calculated from the age of 65, but there are not very good reviews about Rosno, and some of them from pensioners. Bean Insurance, formerly the first insurance company to insure before 80 years old, has now changed the rules and insures only up to 70. Liberty insures up to 100 years.

It must be borne in mind that there will be no treatment for chronic diseases - only symptoms, that is, in fact, analgin. So in any case, you need to take with you a huge first-aid kit for all your chronic diseases..

Does the insurance cover chronic diseases?

Traveler's travel insurance does not cover chronic medical treatment. What is meant?

If there is a clear threat to life, then the insurance pays for urgent measures. But does not pay for treatment.

For example, in the event of an exacerbation of gastritis, there is a possibility that the doctor will give pain relievers and will not give anything from gastritis. Or that the doctor will give the necessary pills - and the insurance company will refuse to pay for the appointment. Usually, insurance companies do not refuse to pay at low costs, but one must bear in mind that such a case may be recognized as not insured. It is better not to count on insurance in this case, but to take medicines with you for your chronic diseases.

What happens in a situation when a first-aid kit is not enough and real medical intervention is needed - for example, in the case of a heart attack, perforation of an ulcer, etc. According to the rules of most insurance companies, they pay for hospitalization if there was a clear threat to life. That is, doctors must bring you into a transportable state and after that the insurance will pay for sending the patient home (if the insurance company has such an item). But you need to understand that in such cases, the insurance company may try to find a reason not to pay the bill. There are also restrictions on the maximum amount that is less than the insured amount - for example, $ 10,000 instead of $ 50,000, which is valid for other cases.

You can try to protect yourself and ask the doctor to write:

- there was a threat to life

- the intervention was urgent

- that this case was not an exacerbation of a chronic disease and was not caused by it

But you understand, not every doctor will be ready to risk his license and get involved in such cases..

For a long trip, how best to insure, at home or locally in the host country?

Minuses:

1. The local health insurance policy does not start working on the day of purchase, but after some time. Plus, until the hands reach to take up insurance, while you find an agent, while you take out insurance, a lot of time will pass. If something happens in the first days, there will be no insurance for these days, this is the first minus. In addition, on airplanes and on the road, of course, only travel insurance works, local insurances will not help..

2. The company that will insure you will still have to look. And it will not be easy to find it in all countries. And not all countries will speak English. From well-known and present in many countries, Bupa.com is advised, but it is expensive.

3. Insurance from a local company will usually be more expensive.

4. There are services that are not covered by local insurance by definition. For example, repatriation of a body to its home country.

5. The local company will almost certainly not have Russian language support.

Pros:

1. With some reservations, chronic diseases can be treated. Reservations are mainly related to timing - for each chronic disease there is a period from the start of the purchase of insurance.

2. You will not be offered to send you to your homeland for treatment at the slightest hint of an operation, but will be guaranteed to be treated on the spot.

When traveling for less than six months, local insurance looks like something pointless: chronic diseases will not start to be covered so quickly, travel insurance will be much cheaper. When traveling for more than a year, it makes sense, if only because the insurance company will not try to send you to your homeland for treatment. Although, in some cases, this is rather a minus.

Why take out insurance in Schengen

First, it's a must-have. That is, it will be checked at least once - when the visa is issued. The second time it can be checked at the entrance to the border. In fact, it is checked very, very rarely, but if it is checked and its absence is found, it will either be forced to buy it right at the border, or it will be sent home. I have a whole post about all sorts of nuances - Insurance for Schengen Visa.

Secondly, medicine in Europe is quite expensive, and insurance there is quite cheap, so it is easier to buy insurance than not to buy.

Where to buy insurance for a Schengen visa

You don't have to think about it at all and do it near the consulate while you stand in line for a visa. Or directly at the agency that will issue you a visa. But I personally prefer to buy insurance over the Internet, because it takes literally 5 minutes of time. Moreover, I know what kind of insurance I will take, which is what I wish for everyone - to read reviews about insurance, about the assistants with which these insurance companies work and make a choice with open eyes. God forbid you have to use insurance, but it may not work and will refuse due to a far-fetched reason.

At the moment, I prefer to buy insurance for myself and my family through Cherehapa. Already 10 times I had to use insurance, and so far no problems or questions have arisen. But the main thing, it seems to me, is not to make insurance the cheapest insurance or the first ones available. If you do not know which insurance to choose, do not understand what assistance is, and in general you have a lot of questions, then take a look at my generalizing post about travel insurance.

The cheapest insurance for a Schengen visa

Ahead of the planet of the whole Eurotour agency. Yes, yes, it is in the agencies that the cheapest insurance is, there is simply no cheaper. Eurotour sells them online, and you get a policy from Alpha Insurance with Savitar Assistance, which is pretty good.

Another option to pay less for insurance, for example, for the annual Schengen, is to issue it only for the first trip. Some countries allow this, you need to carefully read the rules for applying for a visa to a specific country. And to save money, it makes sense to look at the annual insurance..

See also my TOP 10 cheapest insurance for Scheenegen.

Why do insurance in Asia

Insurance in Asia is not compulsory, unlike Schengen. therefore «to do or not to do» remains at the will of the traveler.

In principle, medicine in Asia is not as expensive as in Europe. In Thailand, for example, there are usually two different hospitals: one, an expensive one, works with insurance, and the other, a cheap one, works for cash. True, there are different opinions on this matter, someone is advised to go to cheap ones, someone says that only to expensive ones and nothing else. But in general, treatment in a foreign country will cost you more than in your own, if only because in Russia shareware medicine, plus you will not know exactly where to go and what to say there. That is, insurance is some kind of guarantee, especially in difficult cases when serious treatment is required..

One of the most common occurrences in Thailand is a fall from a bike. It is not covered by any insurance, but only by the one where it was included in the package, immediately or for an additional fee (you choose options when buying a policy). Of course, there should be no alcohol in the blood, and you need category A rights. Skating on the board may also not be included, so immediately find out the list of activities that will be insured.

Sometimes you can get medical treatment for cash. Just think of a runny nose or an abrasion on the leg. But, unfortunately, a situation may arise when there is simply not enough cash. That is why this post is, you need to understand why you are making insurance, and when it should be used, and when not. Roughly speaking, for those who love to drink and get behind the wheel, there is a direct road to the prison hospital to be treated for cash.

Where to buy ISOS assistance insurance?

Previously, insurance Consent and a couple of others worked with the ISOS assistant, but then they stopped selling insurance from ISOS, now they have a different assistance. ISOS has stopped working in Russia since the end of 2014. For some time, insurance from it could be found on individual premium bank cards (for example, from Raiffeisen), but now in 2015 I have not found them there anymore. It is a pity, the assistance was good, the best. True, not very cheap. The only option where you can buy it now is directly on its official website. Only support will be in English and you are unlikely to like the prices.

How to find out in advance the hospital where you will be sent

In short, no way. For some reason this «secret» information. The fact is that it is not an insurance company that sends you to the hospital, but a service company (assistance). And depending on which hospitals this assistance has contracts with, they will be sent there. Sometimes one more assistance is used (usually you don't even know about it) and also so that there are agreements with hospitals. But all this is an internal kitchen and you have no access to it. You can call the insurance or assistance, but they will answer you that when you have an insured event, then we will tell you the address of the hospital, they say, it depends on many factors.

In fact, insurance companies send everyone to the same place for a certain period of time (say, a year). And you can try to find a description of insured events on the Internet (reviews), and there, as a rule, the city and the hospital will be indicated. But this is a dreary task, and besides, it is not a guarantee at all.

Do insurance markers look at border crossing

It depends. Sometimes they ask to send a photo with a stamp / visa in the passport, sometimes not. Depends on the insurance and your case. It also depends on whether you have annual insurance and how many days each trip can be (and how many trips per year). You yourself understand that if any suspicions arise, they will definitely ask. I would not violate all these deadlines.

Is it possible to buy several policies in a row

One of the questions is whether it is possible to buy policies one after another even before the trip, breaking the travel insurance into several parts. Can! But not all insurance companies. For example, ERV has a mandatory requirement - 1 insurance must cover the entire travel period, although this is not specified anywhere in the insurance rules.