Separately, I analyzed the general topic. health insurance, it's time to add information on insurance to Schengen on the blog, because there are some nuances. Starting with the fact that it must be done, ending with the fact that it is often more profitable to make annual insurance, and not for specific dates, which not everyone knows about.

And such an important point. Insurance can be done in Europe, or for a Schengen visa. It seems to be the same, but below I will explain what the difference is..

The content of the article

Insurance for Schengen Visa

Why do you need medical insurance

Further there will be a long text and links to my complementary posts about everything related to Schengen. So to begin with:

The choice is always yours, if you want to choose something specifically for yourself, you will have to read, compare and analyze.

Medical insurance for a trip to Europe is compulsory; it will not be possible to do without it for three reasons:

- Firstly, insurance is required for registration of a visa to Schengen. Requirements for different countries may differ, therefore, before taking out insurance, it is better to clarify whether it will be accepted at the consulate of a particular country.

- Secondly, the availability of insurance can be checked at the border. And those who «forgot» their home insurance can be sent home for this insurance. Well, or offer to issue it right there, at the border, if there is an office of an insurance company.

- And finally, for purely mercantile reasons: medicine in Europe is very expensive, cheap hospitals «for cash», as in Asia, no. Insurance to Europe is relatively cheap, you can buy a policy for 300 rubles - it's cheaper than eating once in the same Europe.

Medical insurance for a Schengen visa

Sum insured

According to the rules, for a Schengen visa you need insurance with coverage of at least 30 thousand EURO (not dollars). Just in case, I'll write what it is. What is called «covering», and it would be more correct to call «sum insured» - this is the maximum amount of payments for the insurance. That is, in which case the insurance company will pay the costs until the total amount of payments reaches this figure. This is in theory, in fact, everything is a little different..

Insurance for a year and for specific dates

Insurance can be bought for one trip or several at once. In the first case, insurance is issued for specific dates, for example, for 2 weeks from such and such to such and such a date. In the second case, not only the dates of insurance are indicated, but also the number of days of insurance, for example, insurance for a year from such and such to such and such a number and the number of insurance days 14. Now I will explain the difference.

In the first case, you will be insured for exactly 2 weeks and that's it. Moreover, if for some reason you leave earlier and stay, say, in Europe for only 1 week, then the rest of the insurance will burn out. In the second case, you will be able to enter Schengen several times during the year, and the insurance will end when the total number of days of stay in Schengen exceeds 14 days. Annual insurance is convenient for those who often travel to Europe, you can buy it immediately for a year, indicate, for example, 90 days of insurance, and that's it, you don't have to think about insurance for a whole year. Naturally, you need to buy for as many days as you travel in total throughout the year. If these are two vacations of 14 days, then it is enough to buy an annual insurance with 28 days of stay.

Directly to obtain a Schengen visa, both one-year and five-year, it is enough to make insurance for the first trip, it is not necessary to make insurance for a year. Here everyone chooses for himself what is more convenient and better for him. But! Annual may be cheaper, which is why I am writing about it here.

What is the reason for this? Those who buy an entire year of insurance rarely use all days. Those who buy specific dates almost always use them. Here is simple arithmetic, we calculate the probabilities - hence the cost of insurance.

Average cost of insurance

In his post TOP 15 cheapest insurance in Schengen, I have compiled a whole rating with prices. Be sure to check it out, there are interesting options.

- Insurance for specific dates. You can either spend all these days abroad, or only part of this period, having entered earlier or later, but the insurance will still be valid only on the stated dates. On average, the cost of such insurance is about 0.7-1.7 euros per day. For 10-14 days, such insurance will cost 500-1500 rubles. But there are options for choosing an insurance company (almost everyone has this type of insurance) and, most importantly, assistance, however, and the price may not be the cheapest.

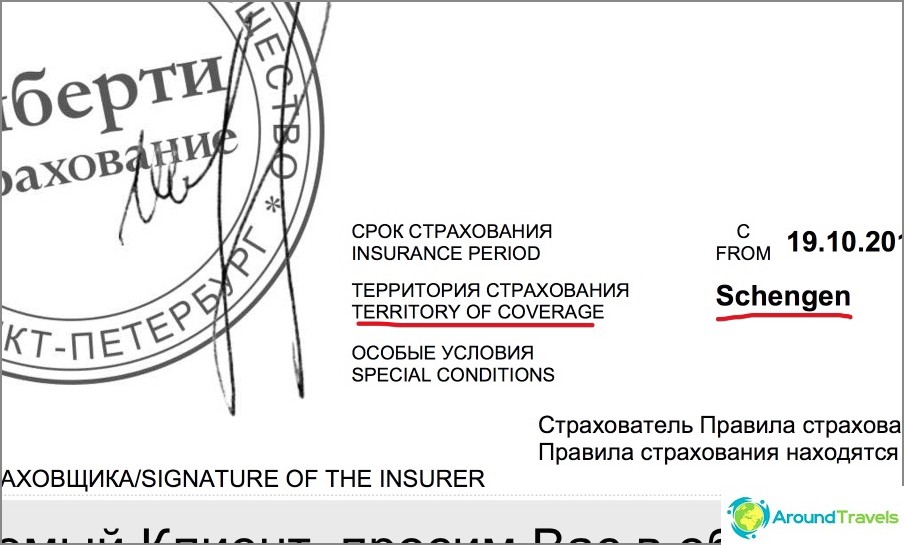

- Annual insurance for a certain number of days. For example, for a total of 30-60 days throughout the year. That is, the number of trips is unlimited and the days for all trips are counted. Usually, this is the cheapest insurance if the person travels abroad several times a year. Such insurance can cost 500-1500 rubles. The cheapest way to do it is in a visa agency, I recommend Eurotrip, proven over the years and by a bunch of people. The link will be a special price for the readers of my blog. From insurance companies, such policies are offered, for example, by Liberty.

- Annual insurance without limiting the number of trips, but limiting the duration of each trip. Usually, the duration of the trip should not exceed 45-60 days. After the trip, you must return to Russia (specifically to Russia, and not to travel to a neighboring country). So to say, reset the counter and go on the next trip (the insurance starts to work again). Sometimes such insurance is attached to travel bank cards, for example, to AllAirlines card.

Please note that insurance for a long, uninterrupted trip usually costs more. Therefore, if it seems to you that there is no limit on the duration of one trip and at the same time the insurance has a small cost (less than 100 euros for 180 days), it makes sense to double-check everything..

In general, before buying insurance, call your bank. It is possible that you already have excellent insurance with a bunch of additional bonuses, you just need to activate and print it.

Where to buy insurance

I recommend the Cherekhapa service, where you can compare prices for 16 insurances at once. The service has existed for a long time and there are all the necessary insurance companies in their list. Now there is no need to look at a dozen sites of insurance companies and compare prices, insurance conditions, assistance. Everything is in one place. In addition, they still provide normal support (which can not be said about insurance, where managers do not know anything) on insured events and can advise on various points related to the insurance contract, the choice of insurance, etc. It's funny, but some insurance companies still don't even buy a policy online ...

And such an important point - as intermediaries, they play a very positive role, the clients of the service find themselves in a more privileged position than other insurance clients. This is a fact, I checked it myself, when I got the entire sum insured. If something is not clear, then I have detailed instructions., how to compare insurance on Cherekhap.

Insurance is not for a trip, but for a visa

I deliberately put this in a separate subheading because it is important. As I wrote at the very beginning, you can make insurance for a trip to Europe, or you can do it especially for a visa. The fact is that our Russian insurance companies operate so-so, so some travelers prefer not to make any insurance at all, but to have a credit card in stock or cash. The option in my opinion is dubious, but having already experience communicating with insurance companies and often reading reviews about them, I can understand this position too, especially if the person has money.

So, if you are going to use travel insurance in full and carefully approach this issue, then this paragraph is not for you. But if you rely more on credit / cash, then read on. Since it is impossible not to do insurance at all when traveling to Europe (they just won't give you a visa), you can make the cheapest insurance just to apply for a visa. There are different options, but I would recommend doing it at the Eurotour agency, it costs mere pennies. But I recommend this insurance, not only because of the price (although you still won't find cheaper), but because it is also working! You will get insurance from Alpha Insurance with Savitar, but if you take it directly from Alpha, there will be a completely different price and very poor GVA assistance.

What is assistance?

If you do not just need to buy insurance for a visa, but you also intend to receive medical assistance, then you need to understand a little about this issue. This is especially true for those who are going to go in for extreme sports in Europe, for example, skiing (you need an Active Rest package). Since I am not extreme, I usually apply for insurance when the child has a high temperature (experience of applying for insurance in Poland).

The insurance company that sells you the policy and the company with which you will communicate on the phone in the event of an accident are two different organizations. Each insurance company works with one or more assistance companies. When you buy a policy, it contains an Assistant Company that will support your policy. It is imperative to pay attention to what kind of assistance is indicated in your policy - it often happens that the information on the site differs from reality, and the operators from the call center do not fumble about this issue at all. It is advisable to find out the assistance in advance.

It is the assistance that you will call if something happens. It is from the assistance and its agreements with hospitals that it will depend on which hospital you will be sent to and how the payment for the treatment will take place. In the end, the assistance depends on how polite and adequate the operator will be and in what language the support will be conducted. If bad reviews about the work of an insurance company are associated with such problems, then see who was the assistance and look for an insurance company that works with another assistance.

But problems with payment, refusal to pay for transport, the speed of coordination of any monetary issues - these are the jambs of the insurance company itself, and you can choose another insurance company with the same assistance.

And most importantly, remember that the insurance policy works according to certain rules. Most of the negative reviews and claims to insurance are based on ignorance and non-compliance with the rules of this insurance. Read carefully the rules written on your policy (not on the website - namely, on the copy sent to you by email, they may differ). And if something happens - first of all call the assistance. The insurer may refuse to pay any medical expenses not agreed with them.

P.S. Read more about the nuances of choosing an insurance company, about the rating of assistance, about the procedure for using insurance, read in my post - travel insurance.